AK102-112192-926-26 1338KB Mar 12 2011 09

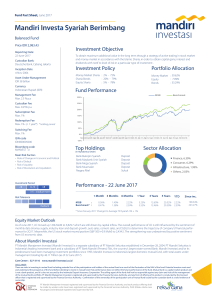

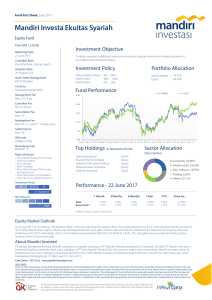

advertisement

1

Akuntansi untuk

Investasi

Mengapa perusahaan berinvestasi

pada perusahan lain

Pelindung Keamanan

Kebutuhan kas yg

musiman

Investasi untuk suatu imbal

hasil

Lanjuttt

2

3

Invetasi untuk mendapatkan

pengaruh

Pembelian untuk

mendapatkan

pengendalian

4

Definisi EFEK

Menurut Undang-undang pasar modal psl

1 point 5

Efek adalah surat berharga, yaitu surat

pengakuan hutang, surat berharga

komersial, saham, obligasi, tanda bukti

hutang, unit penyertaan, kontrak

investasi kolektif, kontrak berjangka

atas efek, dan setiap derifatif dari efek

Klasifikasi efek Investasi

Efek Hutang Umumnya memiliki karakteristik

sebagai berkut:

1. Nilai jatuh temponya mewakili nilai yang

harus dibayarkan pada pemegang efek

hutang pd saat jatuh tempo.

2. Suatu tingkat bunga yg menetapkan

pembayaran bunga secara periodik.

3. Tanggal jatuh tempo yg mengindikasikan

kapan kewajiban akan diselesaikan

5

Klasifikasi efek investasi

Efek ekuitas Mewakili kepemilikan dalam

suatu perusahaan.

Lembar-lembar saham ini biasanya

mengandung hak untuk memperoleh

deviden dan untuk memberikan suara

dalam kegiatan perusahaan.

Dan memiliki potensi untuk kenaikan

secara signifikan atas harga efek tsb.

6

Klasifikasi efek investasi

Efek Hutang/

Ekuitas

Hingga

jatuh

tempo

Efek dibeli untuk tujuan ditahan

hingga jatuh temponya

Diperdagangkan

Efek dibeli dengan tujuan untuk

dijual dalam waktu dekat

Tersedia

u/ dijual

Efek yg tidak dikategorikan

diperdagangkan atau ditahan

hingga jatuh tempo.

7

8

Efek-efek dipasar Modal

• Saham

• Obligasi

• Derivatif (warans, rights, option,

futures contract)

• Efek lain (unit penyertaan reksa

dana dan efek beragun aset

9

Saham

• Surat berharga sebagai bukti

penyertaan atau pemilikan individu

maupun institusi dalam suatu

perusahaan

10

Beberapa istilah penting saham

• Laba per saham, laba bersih setelah

pajak dibagi dengan jumlah lembar

saham yg telah disetor

• Kapitalisasi, perkalian harga saham di

bursa (market price) dg jumlah lembar

saham yg disetor

• Capital gain/loss, keuntungan/kerugian

yg diperoleh investor dari selisih harga

beli dan harga jual suatu saham

11

• Nilai nominal, nilai yg tertera pd lembar

saham yg besarnya ditentukan dalam

anggaran dasar perusahaan

• Nilai buku per saham, total nilai ekuitas

dibagi total jumlah saham yg beredar

• Nilai pasar, harga jual saham

• Deviden, bagian keuntungan

perusahaan yang dibagikan kepada

pemegang saham

• Price earning rasio, rasio harga pasar

saham dengan laba per saham

Klasifikasi efek investasi

Hutang

Ditahan

hingga

jth

tempo

Tersedia

u/dijual

Metode biaya

ekuitas

diperdag

angkan

Metode

ekuitas

12

13

Investasi dalam saham biasa

• Metode yg digunakan tergantung dari

pengaruh atau kontrol yg dilakukan oleh

investor terhadap perusahaan yg ingin

dikuasainya (investee)

• Besarnya pengaruh ini merupakan faktor

utama untuk menjelaskan apa yg investor

dan investe tampilkan dalam laporan

keuangan yg merupakan investasi dalam

saham biasa, berdasarkan metode Cost

(biaya) atau metode Equity (Ekuitas).

14

Investasi dalam saham biasa

• Konsolidasi melibatkan

penggabungan untuk pelaporan

keuangan aktiva, kewajiban,

pendapatan dan beban individual

untuk dua atau lebih perusahaan

yang berhubungan istimewa

seakan-akan mereka adalah satu

perusahaan.

15

• Konsolidasi umumnya merupakan

pengendalian oleh suatu

perusahaan (induk

perusahaan/parent) terhadap

perusahaan lainnya (anak

perusahaan/subsidiary)

16

• Metode ekuitas digunakan untuk pelaporan

eksternal jika investor mempunyai pengaruh

signifikan dalam kebijakan operasi dan

keuangan investee dan konsolidasi tidak

sesuai.

• Metode ekuitas tidak dapat digunakan

sebagai pengganti konsolidasi jika

konsolidasi sesuai.

• Metode ekuitas digunakan utamanya untuk

pelaporan investasi selain pada anak

perusahaan, metode ini paling sering

digunakan jika suatu perusahaan mempunyai

kepemilikan 20 – 50 % pada saham

perusahaan lain.

17

• Metode biaya digunakan dalam

pelaporan investasi dalam efek ekuitas

yang tidak diperdagangkan jika

konsolidasi dan metode ekuitas tidak

sesuai untuk digunakan.

• Untuk efek ekuitas yang

diperdagangkan, jika konsolidasi dan

metode tidak sesuai untuk digunakan,

investasi biasanya dicatat

menggunakan metode biaya dan

disesuaikan dengan nilai pasar.

Kriteria untuk menentukan besarnya

pengaruh suatu perusahaan

Representation on the investee’s Board of

Directors

Participation in the investee’s policymaking process

Material intercompany transactions.

Interchange of managerial personnel.

Technological dependency.

Extent of ownership in relationship to

other ownership percentages.

18

Ukuran signifikansi suatu

investasi

19

Kepemilikan Investor atas

saham beredar Investee

0%

{

Nilai

wajar

(cost

Method)

Equity

Method

20%

Consolidated Financial

Statements

50%

100%

Dalam bbrp kasus

pengaruh/pengendalian dapat terjadi dg

kepemilikan kurang dari 20%.

20

Ukuran siknifikan suatu investasi

Kepemilikan Investor atas

saham beredar Investee

Nilai

wajar

(cost

Method)

20%

{

0%

Equity

Method

Consolidated Financial

Statements

50%

Pengaruh siknifikan umumya

diasumsikan berkisar antara 20% 50% kepemilikan.

100%

21

Ukuran siknifikan suatu investasi

Hak pemilikan Investor atas

saham yg beredar Investee

0%

Equity

Method

20%

Consolidated Financial

Statements

50%

{

Nilai

wajar

(cost

Method)

Laporan keuangan thd suatu

perusahaan yg berhubungan harus

di konsolidasi.

100%

22

Cost Method/Metode biaya

• ABC Company membeli 20 %

saham biasa XYZ seharga

$100,000 pd awal tahun tapi tidak

berpengaruh signifikan atas XYZ.

Investasi pd XYZ

saham biasa

$100,000

Kas

$100,000

23

Cost Method

• Selama periode berjalan, laba XYZ

$50,000 digunakan untuk bayar

deviden $20,000.

Kas ($20,000 X .20)

Pendapatan deviden

$4,000

$4,000

The Equity Method—

Pengaruh signifikan (20 - 50 %)

• Dilaporkan oleh

Investee:

– Laba/rugi bersih

– Pengumuman

deviden

• Pengaruh pada Investor:

– Mencatat

pendapatan/kerugian

dari investasi,

meningkatkan/menur

unkan akun investasi.

– Mencatat

aktiva(kas/piutang),

menurunkan akun

investasi

24

The Equity Method—Equity

Accrual

• ABC Company menguasai signifikan XYZ

Company dg membeli 20 % saham biasa XYZ

Company laba pada tahun berjalan XYZ $60,000.

Jurnal laba atas Investasi ABC di XYZ

Investasi pd saham biasa ($60,000 X .2) $12,000

pendapatan dari Investee

$12,000

25

26

Equity pengakuan Dividends

• Jika XYZ mengumumkan pembayaran

deviden $20,000 jurnal yg dibuat ABC

Kas ($20,000 X .20)

$4,000

Investasi pd

saham Biasa XYZ

$4,000

Efek metode ekuitas

Efek ekuitas Tujuannya agar

dapat mengendalikan atau

mempengaruhi secara

signifikan operasi dari

perusahaan target .

27

Different Accounting

Treatments

Classification

of Securities

Held to maturity

Available for sale

Trading

Equity method

Types of

Securities

Disclosure

on the

Balance

Sheet

28

Treatment of

Temporary

Changes in

Value

Debt

Amortized cost

Not recognized

Debt/equity Fair market value Reported in

stockholders’

equity

Debt/equity Fair market value Reported on the

income statement

Equity

Historical cost

Not recognized

adjusted for

changes in the

assets of the investee

Purchases of Debt Securities

On May 1, Douglas Company purchases

$100,000 in U.S. Treasury notes at 104¼,

including brokerage fees. Interest is 9%

payable semiannually on January 1 and July

1. The debt securities are classified by the

purchaser as trading securities.

Accrued interest on May 1 is $3,000, calculated

as follows:

$100,000 x .09 x 4/12 = $3,000

29

Purchases of Debt Securities

Asset Approach

Purchase date:

May 1 Investment in

Trading Securities 104,250

Interest Receivable

3,000

Cash

107,250

Continued

30

Purchases of Debt Securities

Revenue Approach

Purchase date:

May 1 Investment in

Trading Securities 104,250

Interest Revenue

3,000

Cash

107,250

Continued

31

Purchases of Debt Securities

Receipt of semiannual payment:

Asset Approach

July 1 Cash

4,500

Interest Receivable

Interest Revenue

3,000

1,500

Revenue Approach

July 1 Cash

Interest Revenue

4,500

4,500

32

Purchase of Equity Securities

Purchased 10,000 shares of Dave’s Deli

common shares at $2 per share.

Treated as available-for-sale because

management has no intention of holding

these securities for a a long period of time

and will sell them as soon as it is

economically advantageous

33

Purchase of Equity Securities

Citty Co. purchased 1,000 shares of AB

Company common shares at $2 per share.

Available-for-Sale

Investment in Available-forSale Securities—AB Company 2,000

Cash

2,000

34

Purchase of Equity Securities

Citty Co. purchased 100,000 shares of AB

Company common shares at $2 per share.

Assume that the 100,000 shares

purchased represents 20 percent of the

outstanding voting stock of AB Company.

This investment gives the investor

significant influence over AB Company.

35

Purchase of Equity Securities

Purchased 100,000 shares of Dave’s Deli

common shares at $2 per share.

Trading Securities

Investment in Trading Securities—

AB Company Common Stock

2,000

Cash

2,000

36

PV of Debt Securities

On January 1, 2004, Silmaril Technologies

purchased 5-year, 10% bonds with a face

value of $100,000 and interest payable

semiannually on January 1 and July 1. The

market rate on bonds of similar quality and

maturity is 8%.

37

PV of Debt Securities

Present value of principal:

FV = $100,000; N = 10; I = 4%

Present value of interest payments:

$ 67,556

PMT = $5,000; N = 10; I = 4%

Total present value of the bonds

40,554

$108,110

Investment in Trading Securities

Cash

108,100

108,100

38

Interest Revenue for Debt

Securities (Trading)

When the first interest payment is

received from Silmaril, the following

entry would be made:

July 1 Cash

Interest Revenue

5,000

5,000

39

Interest Revenue for Debt

Securities (Held-to-Maturity)

When the first interest payment is

received from Silmaril, the following

entry would be made:

July 1 Cash

5,000

Interest Revenue

4,324

Investment in Held-toMaturity Securities

676

$108,110 x .04

40

Interest Revenue for Debt

Securities (Held-to-Maturity)

When the second interest payment is received,

the interest revenue is determined by the yield

times the bond carrying value.

Jan 1 Cash

5,000

Interest Revenue

4,297

Investment in Held-toMaturity Securities

703

$107,434 x .04

41

Determining the Appropriate

Accounting Method

Account for as

trading or

available-for-sale

Equity method

Ownership

No

significant

influence

0%

20%

Equity method

and consolidation

procedures

Percentage

Significant

influence

Control

50%

100%

42

Determining the Appropriate

Accounting Method

In the absence of persuasive

evidence to the contrary, equity

securities are classified as

trading or available for sale

when ownership is less than 20

percent.

Summary

43

Determining the Appropriate

Accounting Method

The equity method is used when

ownership is such that the

investor has the ability to

significantly influence or control

the investee’s operations.

Summary

44

Determining the Appropriate

Accounting Method

Ownership

Interest

More than 50%

20% to 50%

Less than 20%

Control or

Degree of

Influence

Control

Accounting

Method

Equity method

and consolidation

procedures

Significant Equity method

influence

No

Account for as

significant trading or

influence

available for sale

45

Applicable

Standard

APB Opinion #18

FASB Exposure

Draft

APB Opinion #18

FASB Statement

No. 115

Revenue for Equity Securities

Classified as Trading and AFS

AB Company announces dividends of

$0.25 per share. Assume that Citty Co.

owns 1,000 shares

Cash

Dividend Revenue

250

250

46

Revenue for Equity Securities

Classified as Trading and AFS

AB Company announces dividends of

$0.25 per share. Assume that Citty Co.

owns 100,000 which represents 50

percent of the outstanding voting stock.

Cash

25,000

Investment in AB Company

Stock

25,000

47

Revenue for Equity Securities

Classified as Trading and AFS

AB Company reports an income of

$250,000 for the year. Again, assume

that Citty Co. owns 50 percent of the

outstanding voting stock.

Investment in AB Company

Stock

125,000

Income from Investment

in AB Company Stock

125,000

48

Equity Method: Purchase For

More than Book Value

The net assets of Stewart Inc. was $500,000

at the time Phillips Manufacturing Co.

purchased 40% of the common shares for

$250,000 on January 1, 2005. The market

value of the net assets of Stewart Inc. would

be $625,000, which is $125,000 more than

the book value. Only $50,000 of this is

attributed to depreciable assets.

$250,000 ÷ .40

49

Equity Method: Purchase For

More than Book Value

The average remaining life of the

depreciable assets is 10 years and the

special operating license is to be

amortized over 20 years.

Additional depreciation ($50,000 x 0.40)/10

License amortization ($75,000 x 0.40)/20

$2,000

1,500

$3,500

50

Equity Method: Purchase For

More than Book Value

Stewart Inc. declared and paid

dividends of $70,000 to common

stockholders during 2005, and it

reported net income of $150,000 for the

year ended December 31, 2005.

51

Equity Method: Purchase For

More than Book Value

Investment in Stewart Inc. Common Stock

Acquisition cost 250,000 Dividends

Share of earnings 60,000 Additional

depreciation

Additional

amortization

310,000

Balance

278,500

28,000

2,000

1,500

31,500

52

Accounting for Temporary

Changes in Value of Securities

Classification

of Security

Disclosed

at

Report FMV

Change On

Trading

Fair market

value

Income

statement

Availablefor-sale

Fair market

value

Stockholder’s

equity

Held-tomaturity

Amortized

cost

Not

recognized

53

Accounting for Temporary

Changes in Value of Securities

Eastwood Inc. purchased the following securities on

March 23, 2005.

• Trading securities:

– Purchase price (Security #1)

$ 8,000

– Value end of year (#1)

$ 7,000

– Purchase price (#2)

$ 3,000

– Value end of year (#2)

$ 3,500

• Available-for-sale securities:

– Purchase price (#3)

$ 5,000

– Value end of year (#3)

$ 6,100

Continued

54

Accounting for Temporary

Changes in Value of Securities

• Available-for-sale securities:

– Purchase price (#4)

– Value end of year (#4)

• Held-to-maturity securities:

– Purchase price (#5)

– Value end of year (#5)

Continued

$12,000

$11,500

$20,000

$19,000

55

Accounting for Temporary

Changes in Value of Securities

Initial Purchase Entry

Investment in Trading Securities

Investment in Available-for-Sale

Securities

Investment in Held-to-Maturity

Securities

Cash

Continued

11,000

17,000

20,000

48,000

56

Accounting for Temporary

Changes in Value of Securities

57

By the end of the year, the value of

the trading securities decreased from

$11,000 to $10,500.

December 31, 2005:

Unrealized Loss on Trading Securities

Market Adjustment—Trading Securities

Continued

500

500

Accounting for Temporary

Changes in Value of Securities

58

By the end of the year, the value of

the available-for-sale securities

increased from $17,000 to $17,600.

December 31, 2005:

Market Adjustment—Available-for-Sale

Securities

Unrealized Increase/Decrease in Value

of Available-for-Sale Securities

600

600

Accounting for Temporary

Changes in Value of Securities

FASB No. 115 puts an end

to “cherry-picking.” This

is the practice of

selectively selling

securities whose prices

have increased, while

keeping those that have

experienced losses or

have maintained their

historical cost.

59

Accounting for Temporary

Changes in Value of Securities

Partial Balance Sheet for Eastwood Inc.

Assets

Invest. in trading securities

$11,000

Market adjustment—trading sec.

(500) $10,500

Invest. in available-for-sale sec. $17,000

Market adjustment

600 17,600

Invest. in held-to-maturity sec.

20,000

$48,100

Stockholders’ Equity

Add unrealized increase in

available-for-sale securities

$ 600

60

Accounting for Temporary

Changes in Value of Securities

Partial Income Statement for Eastwood Inc.

Other expenses and losses:

Unrealized loss on trading

securities

$500

61

Sale of Securities

On April 1, 2005, the investment in

Silmaril’s debt securities is sold for

$103,000, which includes accrued interest

of $2,500. Interest revenue of $2,105

($105,248 x .08 x 3/12) would be recorded.

On January 1, the debt securities had a

carrying value of $105,248. The required

amortization for the three-months’ premium

between January 1 and April 1 is $395.

62

Sale of Securities

Entry to record accrued revenue and to amortize

premium:

Apr. 1 Interest Receivable

2,500

Investment in Held-to

Maturity Securities

395

Interest Revenue

2,105

Entry to record sale:

Apr. 1 Cash

103,000

Realized Loss on Sale of

Securities

4,353

Interest Receivable

2,500

Investment in Held-to

Maturity Securities

104,853

63

Transferring Securities

Between Categories

Transferred

From trading

To trading

From held to maturity to

available for sale

Treatment of

Change in Value

Any unrealized change in value not

previously recognized will be

recognized in net income in the

current period.

Any unrealized change in value not

previously recognized will be

recognized in net income in the

current period.

Recognize any unrealized change in

value in a stockholders’ equity

account.

Continued

64

Transferring Securities

Between Categories

Transferred

From available for sale

to held to maturity

Treatment of

Change in Value

Any unrealized change in value

recorded in a stockholders’ equity

account is to be amortized over the

security’s remaining life using the

effective-interest method.

Statement of Financial Standards No. 115, par. 15d

65

Transferring Securities

Between Categories

Assume:

Cost of trading security

Fair market value, end of 2006

Fair market value at transfer

date

Continued

$3,000

3,600

3,800

66

Transferring Securities

Between Categories

Investment in Available-for-Sale

Securities

3,800

Market Adjustment--Trading

Securities

600

Unrealized Gain on Transfer

of Securities

200

Investment in Trading Securities

3,000

67

Transferring Securities

Between Categories

Assume:

Cost of available-for-sale security

Fair market value, end of 2006

$12,000

10,700

Transfer from the availablefor-sale category to the trading

security category.

Continued

68

Transferring Securities

Between Categories

Investment in Trading Securities 10,300

Market Adjustment--Trading

Securities

1,300

Unrealized Loss on Transfer

of Securities

1,700

Unrealized Increase/Decrease

in Value of Available-forSale Securities

1,300

Investment in Available-forSale Securities

12,000

69

Transferring Securities

Between Categories

Assume:

Cost of held-to-maturity

security

Fair market value, Dec. 31,

2006

20,000

20,700

Record a transfer from held-to-maturity to

the available-for-sale category.

Continued

70

Transferring Securities

Between Categories

Investment in Available-forSale Securities

Unrealized Increase/

Decrease in Value of

Available-for-Sale

Securities

Investment in Held-toMaturity Securities

71

20,400

400

20,000

Transferring Securities

Between Categories

Assume:

Cost of available-for-sale

securities

Fair market value, end of 2006

Fair market value at transfer date

$5,000

6,500

5,900

Record a transfer from availablefor-sale to held-to-maturity.

Continued

72

Transferring Securities

Between Categories

Investment in Held-to-Maturity

Securities

5,900

Unrealized Increase/Decrease

in Value of Available-for-Sale

Securities

600

Investment in Available-forSale Securities

Market Adjustment—

Available-for-Sale

Securities

73

5,000

1,500

Cash Flows from Gains and

Losses on Available-for-Sale

Caesh Company began with a $1,000

investment on January 1, 2005.

Cash sales

Cash expenses

Purchases of investment securities

Sale of investment securities

(costing $200)

Continued

$1,700

(1,400)

(600)

170

74

Cash Flows from Gains and

Losses on Available-for-Sale

The market value of the remaining securities

was $500 on December 31, 2005.

Sales

Expenses

Operating income

Realized loss on sale of securities

Net income

Continued

$1,700

(1,400)

$ 300

(30)

$ 270

75

Cash Flows from Gains and

Losses on Available-for-Sale

Caesh Company will report a $100

unrealized increase in the value of it

available-for-sale portfolio.

This $100 unrealized increase

is reported as an increase in

Accumulated Other

Comprehensive Income.

Continued

76

Cash Flows from Gains and

Losses on Available-for-Sale

77

The statement of cash flows for Caesh

Company for 2005 appear as follows:

Operating activities:

Net income

$ 270

Plus realized loss on sale of securities

30 $ 300

Investing activities:

Purchase of investment securities

$(600)

Sale of investment securities

170 (430)

Financing activities:

Initial investment by owner

1,000

Net increase in cash

$ 870

78

Classification and Disclosure

• Trading securities

– The change in net unrealized holding gain or

loss that is included in the income statement.

• Available-for-sale securities

– Aggregate fair value, gross unrealized holding

gains and gross unrealized holding losses, and

amortized cost basis by major security type.

– The proceeds from sales of available-for-sale

securities and the gross realized gains and

losses on those sales and the basis on which

Continued

cost was determined

in computing realized

gains and losses.

79

Classification and Disclosure

• Available-for-sale securities (continued):

– The change in net unrealized holding gain or

loss on available-for-sale securities that has

been included in stockholders’ equity during the

period.

• Held-to-maturity securities:

– Aggregate fair value, gross unrealized holding

gains and gross unrealized holding losses, and

amortized cost basis by major security type.

– The company should disclose information

about contractual Continued

maturities.

80

Classification and Disclosure

• Transfers of securities between categories:

– Gross gains and losses included in earnings

from transfers of securities from available-forsale into the trading category.

– For securities transferred from held-to-maturity,

the company should disclose the amortized cost

amount transferred, the related realized or

unrealized gain or loss, and the reason for

transferring the securities.

chapter 14

The End

81

82