Mandiri Investa Ekuitas Syariah

advertisement

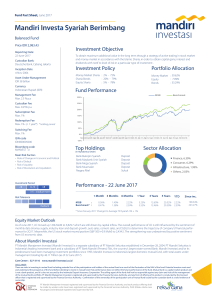

Fund Fact Sheet, June 2017 Mandiri Investa Ekuitas Syariah Equity Fund Price IDR 1,210.58 Investment Objective Reporting Date: 22-June-2017 Custodian Bank: Deutsche Bank, Cabang Jakarta Inception Date 20-August-2013 Asset Under Management IDR 57.09 billion Currency Indonesian Rupiah (IDR) To obtain maximum additional value in the long term through investment in Islamic securities in accordance with the Islamic Sharia. Investment Policy Portfolio Allocation Money Market Sharia : 0% - 20% Equity Sharia : 80% - 100% Bonds Sharia : 0% - 20% Money Market Equity Fund Performance Management Fee Max. 3.75 % p.a MIES 40% Custodian Fee Min. 0.15% p.a : 14.77% : 85.23% ISSI 30% Subscription Fee Max. 1% 20% Redemption Fee Max. 1% (< 1 year*) * holding period 10% Switching Fee Max. 1% 0% ISIN code IDN000157500 -10% Aug-13 Nov-13 Feb-14 May-14 Aug-14 Nov-14 Feb-15 Apr-15 Jul-15 Oct-15 Jan-16 Apr-16 Jul-16 Oct-16 Jan-17 Apr-17 Bloomberg code MANIVES : IJ Top Holdings (In Alphabetical Order) Main risk factors • Risk of Deteriorating Economic and Political Condition • Risk of Default • Risk of Liquidity • Risk of Diminishing of NAV of each participation unit • Risk of Dissolution and Liquidation • Risk of Electronic Media Transaction Investment Period <3 3-5 >5 (Top 5 Sectors) Equity Equity Equity Equity Equity Astra International Buyung Poetra Sembada Indofood CBP Sukses Makmur Telekomunikasi Indonesia Unilever Indonesia Sector Allocation Consumer, 24.86% Infrastructure, 23.04% Misc. Industry, 18.79% Trading, 8.20% Others, 25.11% Performance - 22 June 2017 > 5 : long term 1 Month Risk Tolerance high : MIES Benchmark* : 3 Months 1.43% 1.14% 3.48% 2.62% 6 Months 1 Year YTD Since inc. 3.83% 7.64% 0.84% 11.62% 3.83% 7.64% 21.06% 32.14% *Indeks Saham Syariah Indonensia Equity Market Outlook As of June 2017, JCI moved up 1.6% MoM to 5,829.7 which are still driven by capital inflow. The overall performance of JCI is still influenced by the sentiment of monthly data (money supply, industry loan and deposit growth, auto sales, cement sales, and SSSG) to determine the trajectory of company’s financial performance for 2Q17. Meanwhile, the US stock market moved positive (S&P 500 +0.9 MoM) to 2,434.5. The strengthening was underpinned by positive sentiment from US economic data. About Mandiri Investasi PT Mandiri Manajemen Investasi (Mandiri Investasi) is a separate subsidiary of PT Mandiri Sekuritas established in December 28, 2004. PT Mandiri Sekuritas is Indonesia’s leading investment bank and a subsidiary of PT Bank Mandiri (Persero) Tbk., the country’s largest state-owned Bank. Mandiri Investasi and/or its predecessors have been managing investment portfolios since 1993. Mandiri Investasi is Indonesia’s largest domestic mutual fund, with total assets under management totaling Rp 46.11 Trillion (as of 22 June 2017). Care Center : 527-3110 www.mandiri-investasi.co.id DISCLAIMER There are risks in investing in mutual fund including potential loss of the participation unit holders of the mutual fund as a result of the fluctuation of the NAV of the fund. Potential investor must read and understand the prospectus of the fund before deciding to invest in mutual fund. Past performance does not reflect the future performance of the fund. Mutual fund is a capital market product and is not a bank product, and it is also not secured by the Indonesia Deposit Insurance Corporation. The selling agent of the fund shall not be responsible against any claim and risks of the management of the mutual fund’s portfolio. PT Mandiri Manajemen Investasi is registered and supervised by the Financial Services Authority, and any form of offering of its product is conducted by the licensed officer that is registered and supervised by the Financial Services Authority. Confirmation of the ownership of the participation unit of mutual fund issued by the custodian bank is a valid evidence of ownership. PT Mandiri Manajemen Investasi registered and supervised by the Financial Services Authority, and each product offering shall be made by workers who have been registered and supervised by the Financial Services Authority. PUJK (Pelaku Usaha Jasa Keuangan) and Individual registered and supervised by OJK.