Mandiri Investa Atraktif

advertisement

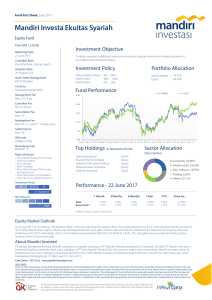

Fund Fact Sheet, September 2017 Mandiri Investa Atraktif Equity Fund Price IDR 4,376.59 Investment Objective Reporting Date: 29-September-2017 To provide optimal long term capital appreciation primarily through investing in listed Indonesian equities. Custodian Bank: HSBC Bank, Jakarta branch Inception Date 30-Aug-2005 Asset Under Management IDR 677.62 billion Currency Indonesian Rupiah (IDR) Investment Policy Portfolio Allocation Money Market Equity Bonds Money Market Equity Bonds : 2% - 20% : 80% - 98% : 0% - 20% Fund Performance Management Fee Max. 3 % p.a MITRA 500% JCI 450% Custodian Fee Max. 0.25 % p.a 400% 350% Subscription Fee Max. 1% 300% 250% Redemption Fee Max. 1% (< 1 year*) * holding period 200% Switching Fee Max. 1% 100% 150% 50% ISIN code IDN000026200 0% Aug-05 Mar-06 Nov-06 Jul-07 Mar-08 Nov-08 Jul-09 Mar-10 Nov-10 Jul-11 Mar-12 Nov-12 Jul-13 Mar-14 Nov-14 Jul-15 Mar-16 Nov-16 Seo-17 Jul-17 Bloomberg code MANTRAK : IJ Top Holdings (In Alphabetical Order) Main risk factors Bank Central Asia Bank Rakyat Indonesia HM Sampoerna Telekomunikasi Indonesia Unilever Indonesia • Risk of Deteriorating Economic and Political Condition • Risk of Default • Risk of Liquidity • Risk of Diminishing of NAV of each participation unit • Risk of Electronic Media Transaction Investment Period <3 : 8.83% : 91.17% : 0% 3-5 >5 Sector Allocation (Top 5 Sectors) Equity Equity Equity Equity Equity Finance, 28.94% Consumer, 25.07% Infrastructure, 10.74% Misc. Industry 6.52% Others, 17.13% Performance - 29 September 2017 > 5 : long term 1 Month 3 Months 6 Months Risk Tolerance high : MITRA Benchmark* : -0.05% 0.63% -0.98% 1.22% 3.67% 5.98% 1 Year 3 Years 5 Years YTD 1.23% 6.04% 4.53% 12.00% 13.73% 33.39% 4.95% 10.55% Since inc. 337.66% 446.80% *JCI Equity Market Outlook As of September 2017, JCI moved up 0.63% MoM to 5,900.85. The overall performance of JCI is supported from local fund despite net outflow from foreign investors as well as earnings season for 3Q17. Meanwhile, the US stock market moved positive (S&P 500 +1.93% MoM) to 2,519.36. The strengthening was underpinned by positive sentiment from the possibility of tax cut that would help US economic growth as well as declining trend from USD. About Mandiri Investasi PT Mandiri Manajemen Investasi (Mandiri Investasi) is a separate subsidiary of PT Mandiri Sekuritas established in December 28, 2004. PT Mandiri Sekuritas is Indonesia’s leading investment bank and a subsidiary of PT Bank Mandiri (Persero) Tbk., the country’s largest state-owned Bank. Mandiri Investasi and/or its predecessors have been managing investment portfolios since 1993. Mandiri Investasi is Indonesia’s largest domestic mutual fund, with total assets under management totaling Rp 50.54 Trillion (as of 29 September 2017). Care Center : 527-3110 www.mandiri-investasi.co.id DISCLAIMER There are risks in investing in mutual fund including potential loss of the participation unit holders of the mutual fund as a result of the fluctuation of the NAV of the fund. Potential investor must read and understand the prospectus of the fund before deciding to invest in mutual fund. Past performance does not reflect the future performance of the fund. Mutual fund is a capital market product and is not a bank product, and it is also not secured by the Indonesia Deposit Insurance Corporation. The selling agent of the fund shall not be responsible against any claim and risks of the management of the mutual fund’s portfolio. PT Mandiri Manajemen Investasi is registered and supervised by the Financial Services Authority, and any form of offering of its product is conducted by the licensed officer that is registered and supervised by the Financial Services Authority. Confirmation of the ownership of the participation unit of mutual fund issued by the custodian bank is a valid evidence of ownership. PT Mandiri Manajemen Investasi registered and supervised by the Financial Services Authority, and each product offering shall be made by workers who have been registered and supervised by the Financial Services Authority. PUJK (Pelaku Usaha Jasa Keuangan) and Individual registered and supervised by OJK.