INVESTMENT LAW Department

advertisement

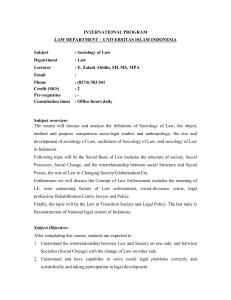

INTERNATIONAL PROGRAM LAW DEPARTMENT – UNIVERSITAS ISLAM INDONESIA Subject : INVESTMENT LAW Department : International Program Lecturer : Dr. Siti Anisah, S.H., M.Hum. Email : [email protected] Phone Credit (CP) Pre-requisites Consultation times : 08122771634 :2 : Commercial Law : By Appointment Subject overview: Since the middle of 1997, Indonesia has faced its most severe economic crisis. The program has had several major revisions and includes major structural reforms, which should ultimately result in an improved investment climate. The Indonesian government continues its policy of actively encouraging domestic and foreign investments and issued several new regulations since 1998 to ease the increasing of capital into Indonesia. The elimination of many restriction of foreign investments have governed since June 1998 such as elimination of restriction of foreign investment retail operations, foreign participation in distribution services, and several previously restricted sectors were opened, including harbours, electricity generation, telecommunications, shipping airlines, and railway. In 2007 new act on investment was enacted. This regulation amalgamated domestic and foreign investment, and arranged based on the any international conventions that was signed by Government of Indonesia. Subject Objectives It is imperative for student to understand the working of investment law particularly direct investment, the issues of investment in Indonesia, and the settlement of dispute between Contracting State and National of the Contracting State and Disputes between Contracting Party and Investor. Furthermore, investment prospect in Indonesia, investment policy in ‘Otonomi Daerah’ Era, and Municipality Investment. Materials and References Adolf, Huala, Perjanjian Penanaman Modal dalam Hukum Perdagangan Internasional (WTO), Jakarta: Grafiti, 2004. Anisah, Siti, Bahan Kuliah Hukum Investasi (Peraturan Perundang-Undangan, Konvensi Internasional, Artikel, Berita), Yogyakarta: FH UII, 2008. Anoraga, Pandji, Perusahaan Multinasional dan Penanaman Modal Asing, Jakarta: Pustaka Jaya, 1995 Dhaniswara K, Harjono, Hukum Penanaman Modal, Jakarta: Grafiti, 2007. Bagus Wyasa Putra, Ida, Aspek-aspek Hukum Perdata Internasional dalam Transaksi Bisnis Internasional, Bandung: Refika Aditama, 2000 Gautama, Sudargo, Indonesia dan Konvensi-Konvensi Hukum Perdata Internasional, Bandung: Alumni, 2002 Jeddawi, Murtir, Memacu Investasi di Era Otonomi Daerah, Kajian Beberapa Perda tentang Penanaman Modal, Yogyakarta: UII Press, 2005 Lubis, T Mulya & Buxbaum, Richard M., Peranan Hukum dalam Perekonomian di Negara Berkembang, Jakarta: Yayasan Obor Indonesia, 1986 Muchlinski, Peter, Multinational Enterprises and the Law, Oxford: Blackwell Publishers, Ltd., 1999. Panjaitan, Hulman & Anner Mangatur Sianipar, Hukum Penanaman Modal Asing, Jakarta: Indhill , 2008 Pritchard, Robert, Economic Development Foreign Investment, and the Law, Issues of Private Sector Involvement Foreign Investment and the Role of Law in New Era, Netherland: Kluwer Law International, 1996. Rachbini J, Didik, Arsitektur Hukum Investasi Indonesia (Analisis Ekonomi Politik), Jakarta: Indeks, 2008. Rajagukguk, Erman, Hukum tentang Investasi dan Pembangunan (Karangan, Komentar dan Berita), Jakarta: Fakultas Hukum Universitas Indonesia , 1994 -------------, Hukum Investasi di Indonesia, Jakarta: Universitas Al-Azhar Indonesia , 2007 Rokhmatuss’dyah, Ana, & Suratman, Hukum Investasi dan Pasar Modal, Jakarta: Sinar Grafika, 2009. Salim H.S., & Budi Sutrisno, Hukum Investasi di Indonesia, Jakarta: Rajawali Pers , 2008 Sumatoro, Hukum Ekonomi, Jakarta: UI Press, 1986 -------------, Bunga Rampai Permasalahan Penanaman Modal dan Pasar Modal/Problems of Investment in Equities and in Securities, Jakarta: Bina Cipta, 1984 Supanca, Ida Bagus Rahmadi, Kerangka Hukum Kebijakan Investasi Langsung di Indonesia, Jakarta: Ghalia Indonesia, 2006 Van Houtte, Hans, The Law of International Trade, London: Sweet & Maxwell, 1995 Assessment The final grade will be determined by a composite evaluation of the student’s performance on the following assessment areas: Task Assignment Value 10% Essay Class Participation Mid Term Exam Final Exam 20% 10% 30% 30% Deadline Before midterm exam (week 5) and after midterm exam (week 11) Before final exam (week 14) During the semester Week 8 Week 16 Assignments Two assignments will be given during the semester. The first assignment requires a search about current issues investment motivation in Indonesia and generally students must then write a report of 2000-2500 words. The second assignment requires student to write a report of 2000-2500 word that gives an analysis of the presentation of the issues in joint venture agreement in Indonesia. Essays In order to assess students understanding in investment law subject, the students are obliged to analyse an actual case that occurs in practice related to the implementation of international convention on investment about a 2000-2500 words. The precise topic will be announced in week 10, and the paper must be submitted in week 14. The assay must be written individually. Class Participation In every meeting, students are hoped for participate in the class, such as asking question and answer the teacher’s question. Examination The midterm test will be held as scheduled by the Department of International Program. The final exam will be held at the end of semester. The exams involve several short answer questions. The exams are 90 minutes in duration. Grading System A A- A/B B+ B B- B/C C+ C C- C/D D+ D E 86100 8385 8082 7679 7175 7068 6467 6163 5660 5355 4952 4548 3544 034 Policy on assessment Essays and assignments will not be accepted after the due date unless arrangements for an extension of time have been made prior to the due date. If you do not agree with the result that you achieve for any piece of assessment for this subject please contact the lecturer immediately. You have a right to know the reasons why your work has received a certain grade and to request a better grade if you believe your work has been unfairly assessed.