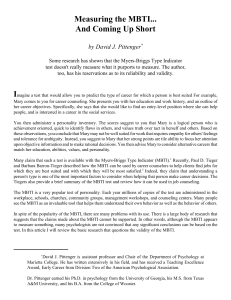

Issuance of securities under asymmetric information (Myers/Majluf 1984) 1. Empirical validity of the theorem of irrelevance 2. Model assumptions of the Myers/Majluf approach 3. An underinvestment equilibrium 4. A numerical example 5. The Pecking Order Theory 6. Information costs under different institutional frameworks 1. Empirical validity of the theorem of irrelevance Price variation in response to stock emissions at US capital markets Average 2-day-excess returns at the time of the announcement Kinds of stocks: Excess returns of stocks emitted by industrial firms: Common stocks -3,14% Preferred stocks -0,19% Convertible preferred stocks -1,44% Convertible bonds -2,07% Straight bonds -0,26% Source: Quelle:Smith (1986): Investment Banking and the Capital Acquisition Process, Journal of Financial Economics, Vol. 1, S. 5 2. Model assumptions of the Myers/Majluf approach Characteristics of a perfect capital market 1. Same market entrance conditions for all market participants, possibility of unlimited borrowing, short-selling, only one interest rate (borrowing rate = lending rate) 2. No transaction costs, no tax 3. Everyone acts as a price taker 4. Symmetric and efficient information, 5. No arbitrage possibilities Notation of Myers/Majluf (1984) I = Investment volume of additional investment S = Investable reserves of the firm, liquidity („financial slack“) E = Issuing volume P = Market value of old shares if event: no emission P´= Market value of old shares if event: emission a = Net present value of the present investment, as a random variable A~ , ~ with market value equal to expected value A = E ( A) b = Present value of the additional investment, as a random variable B~ , ~ with market value equal to expected value B = E ( B ) Va(E) = Market value of old shares given an emission of E Information Structure in Myers/Majluf (1984) Time: t = -1 t=0 t=1 Manager’s Insider Information: Distribution of ~ ~ A and B , S a, b, S a, b, residual S Information open to the public : Distribution of ~ ~ A and B , S Distribution of ~ ~ A and B , S, E a, b, residual S Symmetric information Asymmetric information Symmetric information Raise capital or invest? Pay off => Decision of Management 3. An underinvestment equilibrium Underinvestment in Myers/Majluf (1984) b Region M´: Invest and raise capital b = (E/P´(S+a)) - E Region M: No Investment a = -S a = P´-S b = -E a Market equilibrium given asymmetric information Supply of stocks: Management raises capital and invests, if V a ( E = I ! S ) " V a ( E = 0) => P! ( E + S + a + b) " S + a P! + E => E +b ! E (S + a) P" Demand for stocks: At the stock exchange, the firm receives a market price conditional on the market participant’s perception of the distribution of a and b as well as their knowledge of the manager’s investment strategy. Given an emission, the market price is P ! = S + A ( M !) + B ( M !) ~ A ( M #) " E ( A E = I ! S ), and ~ with B ( M #) " E ( B E = I ! S ) 4. A numerical example of Myers/Majluf (1984) state: s11 s12 s21 s22 pij: 1/4 1/4 1/4 1/4 A: 20 20 6 6 b: 4 2 4 2 Given: S = 0, I=10 and hence E = 0 or E = 10. If the management invests in each state, it follows: P ! ( E = 10"s) = 1 4 # 24 + 1 4 # 22 +1 4 # 10 + 1 4 # 8 = 16 Mistake 1: Va11 Va12 Va21 Va22 20,92 19,69 (<20!) 12,31 11,07 If the management abstains from Investing in s12, it follows: P !( E = 0 s12 , E = 10 sonst) = 1 3 " 24 +1 3 " 10 + 1 3 " 8 = 14 Mistake 2: Va11 Va21 Va22 19,83 (<20!) 11,67 10,50 If the management abstains from investing in s11 and s12, it follows: P !( E = 0 s12 , s11 , E = 10 sonst) = 1 2 " 10 +1 2 " 8 = 9 Va11 Va12 Investment: No investment: 20 20 Va21 Va22 9,47 8,53 Numerical example of Myers/Majluf, Dotted lines between M and M´ at S = 0 and S = 5 b 4 s21 s11 2 s22 s12 6 9 20 b = (E/P´(S+a))-E S=5 b = (E/P´(S+a))-E S=0 -10 a 5. The Pecking Order Theory 1. If possible, firms prefer internal financing. 2. Dividends are tried to be kept constant over time. Positive operating cash flows should be used to reduce debt or to be invested in tradeable securities. Negative cash flows should be compensated by raising debt or selling tradeable securities. 3. In case of need for external financing, the firm will prefer debt over risky equity. That is, the firm will raise capital according to the “Pecking Order” that ranks different sources of financing, if the internal sources of financing are depleted. Firstly the firm will make use of - debt (credits and bank loans, Eurobonds of different kinds), thereafter - hybrid securities (convertible or option bonds, participation papers, obligations), and finally - stock emissions. 6. Information costs under different institutional frameworks Sources of finance of corporates from 1970-1985 (apart from financial firms) in percentage USA Retentions Capital transfers 66,9 UK 66,9 0 72,0 Germany 74,9 2,9 1,4 Loans 23,1 21,4 21,1 Trade credit 8,4 2,8 2,2 Bonds 9,7 0,8 0,7 Shares 0,8 (Eckbo/Masulis (1995)) -10,2 0,8 2,3 4,9 -7,2 61,9 6,7 Short-term securities Other/Statistical Adjustment 42,6 55,2 27,3 4,9 0 2,1 11,9 24,0 2,1 Price variations in response to stock emissions at the German market Average 2-day-excess returns at the time of the announcement Kinds of stocks: Stock excess returns of the examined companies: Common stocks 0,89% All option bonds 0,40% (insignificant) Option bonds cum rights Option bonds ex new 1,41% 0,10% (insignificant) Following 30 days -1,04% (Padberg (1995), p. 235, Entrup (1995), p. 169, 181, 201)