Laporan Tahunan 2015 | PT. BANK SINARMAS Tbk.

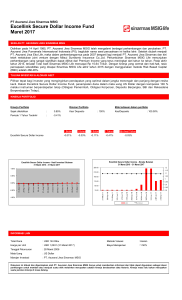

advertisement