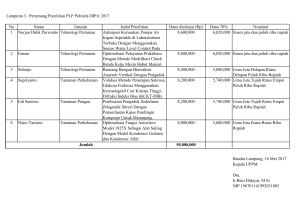

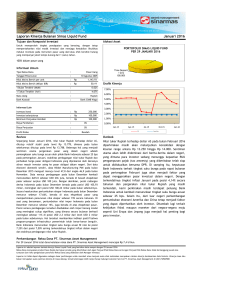

Laporan Manajemen - PT Bank Mizuho Indonesia

advertisement