dasar penerapan tata kelola perusahaan

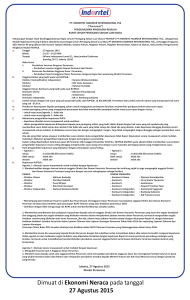

advertisement