Uploaded by

common.user81861

Tugas Audit Kewajiban (LBS 1) - Pengantar Pratik Pengauditan

advertisement

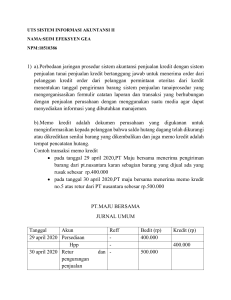

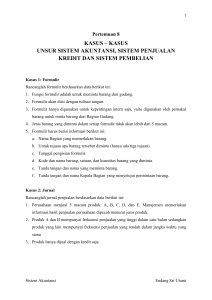

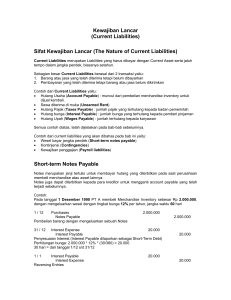

PENGANTAR PRATIK PENGAUDAITAN ASSIGNMENT 8 “LIABILITIES (LBS 1)” Kelompok 4 Kelas A Nofel Andriawan 041711535002 Effatul Mila Alghina 041711535024 Roberthus Nughriyanto Krisono Putra 041711535032 Vena Destia Pratiwi 041711535034 PROGRAM STUDI S1 AKUNTANSI FAKULTAS EKONOMI DAN BISNIS UNIVERSITAS AIRLANGGA BANYUWANGI 2020 1. Prepare the working paper and any necessary adjustments. Jawab : Client : Periode : Subject : Index : No. 1 2 3 4 Apollo Shoes Inc 31 Desember 204 AUDIT PROGRAM LIABILITIES L Audit Procedure Account Payable Dapatkan neraca saldo dari hutang dagang yang tercatat pada akhir tahun. a. Simpan dan telusuri total ke akun buku besar umum. b. vouch contoh saldo untuk pernyataan vendor. Tinjau saldo percobaan untuk hutang pihak terkait. Ketika khawatir tentang kemungkinan hutang yang tidak tercatat, kirimkan konfirmasi kepada kreditur, terutama yang memiliki saldo kecil atau nol dan mereka yang telah melakukan bisnis signifikan dengan perusahaan. Lakukan pencarian untuk kewajiban yang tidak tercatat dengan memeriksa voucher terbuka, faktur vendor dan laporan yang diterima, dan pembayaran tunai yang dilakukan untuk periode setelah akhir tahun. Minta keterangan tentang istilah yang membenarkan klasifikasi hutang sebagai hutang jangka panjang dan bukan hutang lancar. Initial Date Assertion Comment Prepared By : Reviewed By : By Ref Remarks Detail Tie-in Detail Tie-in Existance, Obligations, Accuracy Completeness, Cut-off Classification 1 Other Current Liabilities Untuk estimasi kewajiban, seperti jaminan, tentukan dan evaluasi dasar estimasi, dan hitung ulang estimasi tersebut. Clasification 2 Dapatkan representasi klien tertulis tentang hutang pihak berelasi dan jaminan aset sebagai jaminan atas kewajiban. Existence, Accuracy Apollo Shoes, Inc. Schedule of Current Liabilities For Year Ended 12/31/2014 L-1 Prepared by Reviewed by PBC Acct # Account Title 20000 Accounts Payable 23100 Sales Tax Payable 23200 Wages Payable 23300 FICA Employee Withholding 23350 Medicare Withholding 23400 Federal Payroll Taxes Payable 23500 FUTA Tax Payable 23600 State Payroll Taxes Payable 23700 SUTA Tax Payable 23800 FICA Employer Withholding 23900 Medicare Employer Withholding 2013 2014 Adjustment Debet Credit $12.800.105,97 2014 Audited Balance $4.633.118,09 $1.922.095,91 $14.722.201,88 $0,00 $0,00 $29.470,32 $0,00 $1.318,69 $8.439,65 $8.439,65 $583,99 $11.414,99 $11.414,99 $6.033,01 $118.086,12 $118.086,12 $0,00 $0,00 $0,00 $2.815,47 $55.106,86 $55.106,86 $0,00 $0,00 $0,00 $1.318,69 $8.439,65 $8.439,65 $583,99 $11.414,99 $11.414,99 $0,00 $236.172,00 $236.172,00 24600 Interest Payable $0 $0 $419.920,90 $419.920,90 24700 Bonuses Payable $0 $0 $450.000,00 $450.000,00 24800 Dividends Payable $0 $0 $860.000,00 $860.000,00 $14.766.198,87 f $ 16.901.197,04 f Total Liabilities f : footed $ 4.677.255,25 f $ 2.137.012,17 f $ - Apollo Shoes, Inc. Accounts Payable Schedule For Year Ended 12/31/2014 L-2 Prepared by Reviewed by PBC List of Approved Vendors Balance Debit Adjustment Credit Audited Balance WP Anglonesian Institute for Reprograming and Rehabilitation $ - $ 8.434.889,09 $ 8.434.889,09 L-3 B. Franklin's LP&E $ - $ $ 15.216,88 L-3 Fleur de Lis Catering $ 6.868,12 $ 6.868,12 L-3 Just Boxes $ - $ - % $ 5.502.224,45 L-3 15.216,88 Lawyers "R" Us, LLC $ 1.902.224,45 $ 3.600.000,00 Office Hacks Supplies $ 1.117,19 $ 1.117,19 L-3 Sign Up! $ 4.994,99 $ 4.994,99 L-3 Smart Chip $ - $ - % Squint Telephone and Cellular $ 6.891,16 $ 6.891,16 L-3 Synergizer Battery Company $ - $ - % Tiger Jaguar Dealership $ - $ - % Zrocks $ - $ - % $ 750.000,00 Anderson, Olds, and Watershed $ $ - 1.922.095,91 % : Tidak ada jumlah yang harus dibayarkan untuk pelanggan ini $ 750.000,00 $ 12.800.105,97 $ 14.722.201,88 GA-1 Apollo Shoes, Inc. Search for Unrecorded Liabilities For Year Ended 12/31/2014 From Cutoff Bank Statement: Check Date 3622 13/01/2015 3623 3624 3625 3626 3627 3628 Amount $6.683,93 13/01/2015 14/01/2015 13/01/2015 13/01/2015 13/01/2015 13/01/2015 $2.937,13 $6.868,12 $124,81 $15.216,88 $6.891,16 $6.025,43 3629 13/01/2015 3630 14/01/2015 $927,09 $8.419,69 L-3 Prepared by Reviewed by From Check Register Date of Check Payee 10/01/2015 Smart Chip 10/01/2015 10/01/2015 10/01/2015 10/01/2015 10/01/2015 10/01/2015 Tiger Jaguar Dealership Fleur de Lis Catering Office Hacks B. Franklin's LP&E Squint Cellular Sam Shaw From Voucher Packet Invoice Date 27/12/2014 09/01/2015 31/12/2014 10/01/2015 06/01/2015 05/01/2015 N/A 10/01/2015 Just Boxes 10/01/2015 Synergizer Battery Company 07/01/2015 03/01/2015 3631 14/01/2015 $8.434.889,09 10/01/2015 Anglonesia R&R Institute 27/12/2014 3632 14/01/2015 10/01/2015 Office Hacks 31/12/2014 $1.117,19 Description Annual computer maintenance contract—2015. Automobile maintenance on 1/9/2015. Catered Holiday party. Office supplies purchased 1/10/2015. "For December electricity". December telephone bill. Car washes for fleet of automobiles on 1/13 Packaging material ordered 1/7 The goods were received on January 6 with bill of lading showing a January 3 shipping date and marked FOB, Shipping - Chicago. The receiving report was dated December 31. The accounts payable clerk indicated that the office party was held the afternoon of the 31st and the receiving report was probably not forwarded until the next working day so was not included in year-end accounts payable. This inventory was counted and included in the physical inventory at the end of the year. Business cards, picked up 12/30 BC 3633 3634 3635 3636 13/01/2015 14/01/2015 13/01/2015 13/01/2015 $6.924,96 $4.994,99 $5.174,00 $585,28 10/01/2015 10/01/2015 10/01/2015 10/01/2015 Smart Chip Sign Up! Zrocks Smart Chip 10/01/2015 31/12/2014 10/01/2015 10/01/2015 Computer purchased 1/10/2015. New logos on vehicles on 12/31/2014. Copy machine purchased 1/10/2015. Computer supplies picked up 1/10/2015. Catatan : Cek No. 3628. Sam Shaw adalah karyawan perusahaan. Meski hanya beberapa ribu dolar, ini adalah jumlah yang selangit untuk mencuci mobil milik Apollo dalam jumlah terbatas, dan juga merupakan transaksi pihak terkait. Apollo Shoes, Inc. Notes Payable Schedule For Year Ended 31/12/2014 PBC Acct # N-1 Prepared by Reviewed by (Audited) Balance 31/12/2013 Account Title 27000 Notes Payable-Noncurrent $ 24100 Line of Credit $ Current Portion Long-Term 24200 Debt $ $ Unaudited Balance 31/12/2014 - 10.000.000,00 - 10.041.639,00 Adjustment Debit $ 12.000.000,00 Credit $(12.000.000,00) $ $ 44.403.000,00 $ Audited Balance 31/12/2014 - $ 56.445.004,00 $(12.000.000,00) - $44.403.000,00 $ 12.000.000,00 $12.000.000,00 $ 12.000.000,00 $56.403.000,00 N-1-1 Notes Payable Roll Forward For the Year Ended 31/12/2014 Year-End Balance 31/12/2013 Additions Payments $ $ $ 12.000.000 - Year-End Balance $12.000.000,00 Sebagaimana dicatat pada B-3 dan GA-3.1, line of credit $ 10.000.000 dicatat menjadi wesel bayar $ 12 juta. Utang ini jatuh tempo pada 1/1/2015, sehingga diklasifikasikan kembali menjadi lancar. Line of Credit Roll Forward For the Year Ended 31/12/2014 Year-End Balance 31/12/2013 Additions Deletions $ $ $ 10.000.000,00 44.403.000,00 (10.000.000,00) Year-End Balance $ 44.403.000,00 Catatan: LOC awal sebesar $ 10.000.000,00 digulung menjadi wesel bayar $ 12.000.000 pada tanggal 2-2-14. Pada 6/1/14, LOC baru senilai $ 44.403.000 dimasukkan. Interest Expense Accrual For the Year Ended 31/12/2014 Interest Expense Accrual 12 months 6 months Total N/A $2.033.657,40 $2.033.657,40 N/A $ 978.000,00 1) Line of Credit 9.16% $ 44.403.000,00 07/01/2014 2) Long Term Note Payable 8.15% $ 12.000.000,00 01/02/2014 $978.000,00 Total Accrual for Year End $3.011.657,40 Expense per X-1 $ 2.591.736,50 t 7.26 Catatan: Berdasarkan perhitungan bunga, total beban bunga untuk tahun berjalan seharusnya $ 3.011.657,40 dan hanya $ 2.591.736,50 yang dicatat. Jadi, diperlukan penyesuaian sebesar $ 419.920,90. Jumlah biaya bunga yang dikecilkan ini sangat mendekati nilai bunga 1 bulan, yang konsisten dengan konfirmasi bank yang menyatakan bahwa bunga hanya dibayarkan hingga 30/11/2014. Jurnal Penyesuain AJE Cost of Goods Sold $ 8.434.889,09 Utilities $ 15.216,88 Auditing Fees $ 750.000,00 Legal fees $ 3.600.000,00 Accounts Payable $ 12.800.105,97 Untuk mencatat kewajiban yang tidak tercatat yang ditemukan saat meninjau pengeluaran kas selanjutnya L-2 AJE Notes Payable-Non Current $ Current Portion Long-Term Debt 12.000.000,00 $ 12.000.000,00 Untuk mengklasifikasikan kembali dari LTD ke Current AJE Administrative salary expense $ 181.702,00 Warehouse salary expense $ 54.470,00 Wages payable $ 236,172,00 AJE Interest Expense $ Interest Payable 419.920,90 $ 419.920,90 Entri harus dibuat untuk menambah beban bunga pada Line Kredit untuk bulan Desember. AJE Bonus expense Bonuses Payable $ 450.000,00 $ 450.000,00