Annual Report 2016

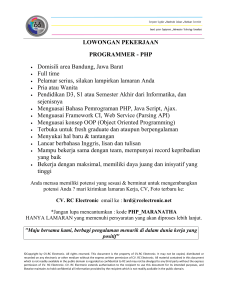

advertisement