Riset Ekonomi Harian - PT Samuel Sekuritas Indonesia

advertisement

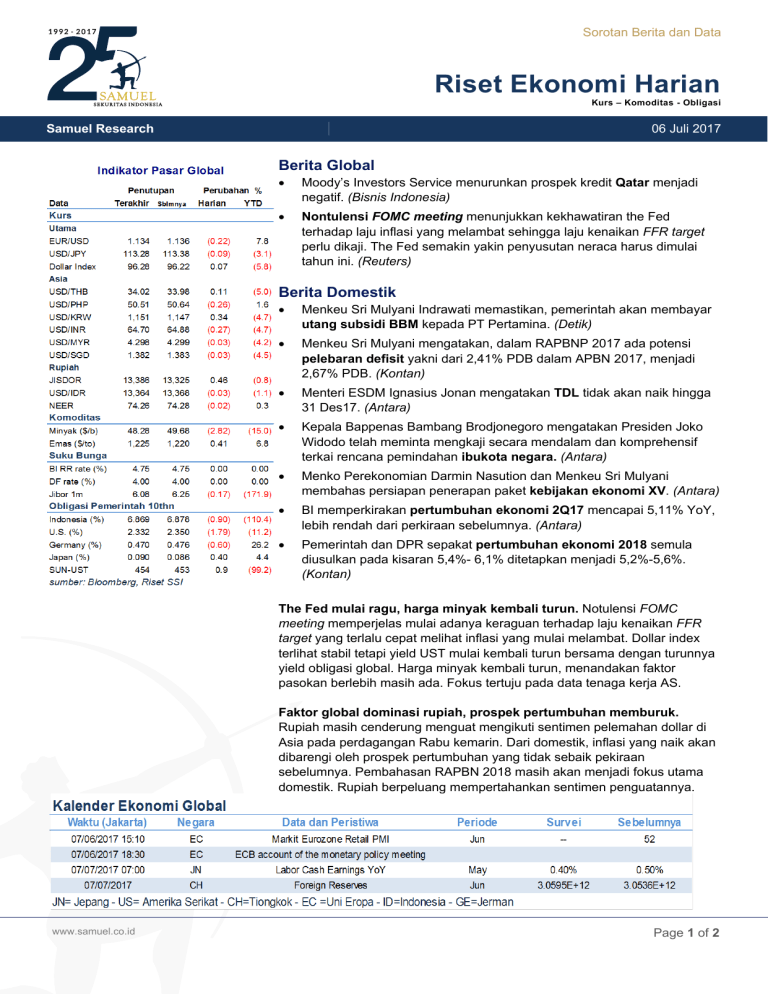

Sorotan Berita dan Data Riset Ekonomi Harian Kurs – Komoditas - Obligasi 06 Juli 2017 Samuel Research Berita Global Moody’s Investors Service menurunkan prospek kredit Qatar menjadi negatif. (Bisnis Indonesia) Nontulensi FOMC meeting menunjukkan kekhawatiran the Fed terhadap laju inflasi yang melambat sehingga laju kenaikan FFR target perlu dikaji. The Fed semakin yakin penyusutan neraca harus dimulai tahun ini. (Reuters) Berita Domestik Menkeu Sri Mulyani Indrawati memastikan, pemerintah akan membayar utang subsidi BBM kepada PT Pertamina. (Detik) Menkeu Sri Mulyani mengatakan, dalam RAPBNP 2017 ada potensi pelebaran defisit yakni dari 2,41% PDB dalam APBN 2017, menjadi 2,67% PDB. (Kontan) Menteri ESDM Ignasius Jonan mengatakan TDL tidak akan naik hingga 31 Des17. (Antara) Kepala Bappenas Bambang Brodjonegoro mengatakan Presiden Joko Widodo telah meminta mengkaji secara mendalam dan komprehensif terkai rencana pemindahan ibukota negara. (Antara) Menko Perekonomian Darmin Nasution dan Menkeu Sri Mulyani membahas persiapan penerapan paket kebijakan ekonomi XV. (Antara) BI memperkirakan pertumbuhan ekonomi 2Q17 mencapai 5,11% YoY, lebih rendah dari perkiraan sebelumnya. (Antara) Pemerintah dan DPR sepakat pertumbuhan ekonomi 2018 semula diusulkan pada kisaran 5,4%- 6,1% ditetapkan menjadi 5,2%-5,6%. (Kontan) The Fed mulai ragu, harga minyak kembali turun. Notulensi FOMC meeting memperjelas mulai adanya keraguan terhadap laju kenaikan FFR target yang terlalu cepat melihat inflasi yang mulai melambat. Dollar index terlihat stabil tetapi yield UST mulai kembali turun bersama dengan turunnya yield obligasi global. Harga minyak kembali turun, menandakan faktor pasokan berlebih masih ada. Fokus tertuju pada data tenaga kerja AS. Faktor global dominasi rupiah, prospek pertumbuhan memburuk. Rupiah masih cenderung menguat mengikuti sentimen pelemahan dollar di Asia pada perdagangan Rabu kemarin. Dari domestik, inflasi yang naik akan dibarengi oleh prospek pertumbuhan yang tidak sebaik pekiraan sebelumnya. Pembahasan RAPBN 2018 masih akan menjadi fokus utama domestik. Rupiah berpeluang mempertahankan sentimen penguatannya. www.samuel.co.id Page 1 of 2 Ekonomi Harian Research Team Andy Ferdinand, CFA Head Of Equity Research, Strategy, Banking, Consumer [email protected] +6221 2854 8148 Rangga Cipta Economist [email protected] +6221 2854 8396 Muhamad Makky Dandytra, CFTe Technical Analyst [email protected] +6221 2854 8382 Akhmad Nurcahyadi, CSA Auto, Aviation, Cigarette, Construction Healthcare, Heavy Equipment, Property [email protected] +6221 2854 8144 Arandi Ariantara Cement, Telecommunication, Utility [email protected] +6221 2854 8392 Marlene Tanumihardja Poultry, Retail, Small Caps [email protected] +6221 2854 8387 Sharlita Lutfiah Malik Mining, Plantation [email protected] +6221 2854 8339 Nadya Swastika Research Associate [email protected] +6221 2854 8338 Evelyn Satyono Head of PWM / Institutional Sales [email protected] +6221 2854 8380 Muhamad Alfatih CSA, CTA, CFTe Senior Technical Portfolio Advisor [email protected] +6221 2854 8129 Ronny Ardianto Institutional Equity Sales [email protected] +6221 2854 8399 Clarice Wijana Institutional Equity Sales [email protected] +6221 2854 8395 Fachruly Fiater Institutional Equity Sales [email protected] +6221 2854 8325 Kelvin Long Head of Equities [email protected] +6221 2854 8150 Yulianah Institutional Equity Sales [email protected] +6221 2854 8146 Lucia Irawati Retail Equity Sales [email protected] +6221 2854 8173 R. Virine Tresna Sundari Head of Fixed Income [email protected] +6221 2854 8170 Yenny Immanuela Batubara Senior Fixed Income Sales [email protected] +6221 2854 8384 Dina Afrilia Senior Fixed Income Sales [email protected] +6221 2854 8309 Rudianto Nugroho Fixed Income Sales [email protected] +6221 2854 8306 Nugroho Nuswantoro Head of Marketing Online Trading [email protected] +6221 2854 8372 Wahyu Widodo Marketing [email protected] +6221 2854 8371 Aben Epapras Marketing [email protected] +6221 2854 8389 Private Wealth Management Equity Sales Team Fixed Income Sales Team Online Trading Sales Team DISCLAIMERS : Analyst Certification : The views expressed in this research accurately reflect the personal views of the analyst(s) about the subject securities or issuers and no part of the compensation of the analyst(s) was, is, or will be directly or indirectly related to the inclusion of specific recommendations or views in this research. The analyst(s) principally responsible for the preparation of this research has taken reasonable care to achieve and maintain independence and objectivity in making any recommendations. This document is for information only and for the use of the recipient. It is not to be reproduced or copied or made available to others. Under no circumstances is it to be considered as an offer to sell or solicitation to buy any security. Any recommendation contained in this report may not be suitable for all investors. Moreover, although the information contained herein has been obtained from sources believed to be reliable, its accuracy, completeness and reliability cannot be guaranteed. All rights reserved by PT Samuel Sekuritas Indonesia www.samuel.co.id Page 2 of 2