Finding the Right Solutions for MSME

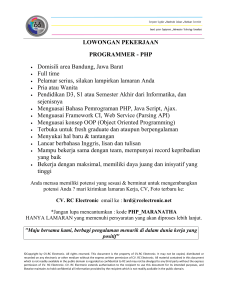

advertisement