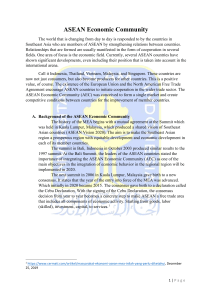

Examining the Possibility of Introducing a Common Currency for ASEAN ─An empirical analysis of symmetry of shocks Vu Tuan Khai Abstract This paper examines the possibility of introducing a common currency for nine ASEAN countries by analyzing symmetry of shocks between these countries using the structural VAR method developed by Blanchard and Quah (1989), and data on CPI and GDP. Two new contributions of the paper are the inclusion of four ASEAN countries (Vietnam, Laos, Cambodia and Myanmar) in the analysis, and the emphasis on the consistency in the signs of responses of GDP and CPI across the countries to structural shocks. The results imply that ASEAN as a whole does not form an optimum currency area, but a group of Indonesia, Malaysia, Singapore, Thailand and the Philippines with high correlations between structural shocks and fast speed of adjustment to shocks, is suitable for a common currency. The results also show that the signs of responses to the same shock are not necessarily consistent across the countries, implying a problem on the validity of the Blanchard-Quah VAR method in analyzing the symmetry of shocks. Keyword: Structural VAR, Long run restriction, Symmetry of Shocks, Common Currency, ASEAN. JEL Classification: E32, F33, F41. 1.Introduction Recently, economic integration is proceeding at a fast pace in the Association of Southeast Asian Nations (ASEAN) countries1). Regional cooperation has become very active and is strongly recognized by the governments in ASEAN to further accelerate economic integration. At the latest annual summit in Vientiane, November 2004, leaders of ASEAN countries reaffirmed ASEANʼs commitment to speed up the integration towards the ASEAN Economic Community that they agreed to establish by 20202). On the other hand, after the Asian crisis, the vulnerability of the dollar-peg system became clear and a more appropriate exchange rate regime is becoming a matter under consideration. With the successful launch of the euro, introducing a common currency is emerging as an interesting option for ASEAN. One criterion to judge if countries are suitable to form a common currency area (CCA) is provided by the concept of symmetry of shocks3) which focuses on the cost aspect of forming a CCA. The argument is that the more symmetric are shocks across a group of countries, the less costs they will have to pay when forming a CCA. The reasoning is as follows. When countries form a CCA, they abandon their monetary policy autonomy, in other words they can no longer adopt different monetary policies. If shocks occurring in these countries are symmetric, they can implement a common monetary policy, for example changing money supply or interest rates. In contrast, if shocks are asymmetric a common monetary policy cannot be adopted, and there is a need to take other policies in an asymmetric way among them4). In this case the adjustment costs are much higher5). 横浜国際社会科学研究 28 (28) 第 13 巻第 1・2 号(2008 年 8 月) Among the existing studies about the symmetry of shocks, there are some papers applying the structural VAR (SVAR) methodology developed by Blanchard and Quah (1989) to calculate structural shocks. Bayoumi and Eichengreen (1993) used two-variable SVAR and annual data to study shocks of ten European countries and compared with regions in the US. Bayoumi and Eichengreen (1994) extended the study above for many parts in the world, including five ASEAN countries6). Using three-variable SVAR, Zhang et al. (2004) studied the feasibility of a monetary union for a group of ten East Asian countries which also contains ASEAN-5 countries. In these papers, however, the study about other ASEAN countries such as Vietnam, Laos, Cambodia and Myanmar (the VLCM group) is still left untouched even though their existence is non-negligible in ASEAN7). Table A1 in the Appendix shows some recent socio-economic indicators of ASEAN including the four VLCM countries. We can see that, while these four countries have a share less than 10% of the total ASEAN in GDP, they account for about one third of ASEAN population, which implies a sizable market. All of them have a ratio of trade to GDP greater than 50%, which is larger than that of the US and Japan, and on average close to that of Korea. This demonstrates their high degrees of openness. In addition, their growth rates have been quite high for the last five years with an average of 7.1% (3% higher than the ASEAN-5 group). All of these facts suggest the potential of the four countries, and now as they have started taking part in the dynamism of economic growth and integration in the region, it can be expected that they will play a more significant role in ASEAN in a near future. Hence, it can be argued that studying these countries has an important meaning. The purpose of this paper, thus, is to incorporate these countries in an analysis to examine whether ASEAN as a whole is suitable to introduce a common currency based on the criterion of symmetry of shocks. The paper uses the SVAR methodology developed by Blanchard and Quah (1989), and data on CPI and GDP. With this method, demand and supply shocks are identified by imposing the so-called long-run restriction which means that in the long run a demand shock has no effect on real GDP. Once structural shocks are identified, correlations of these shocks between countries are calculated and used as a proxy for shock symmetry. This paper also attempts to make another contribution by pointing out the importance of the consistency in the signs of responses of economic variables to shocks between the countries, which has received little attention in the literature so far. The argument is that the correlations can be used as a proxy for symmetry of shocks only when the signs of responses are consistent between the countries. We analyze this by using the impulse response functions in the VAR model. The remainder of the paper is organized as follows. Section 2 explains the model, Sections 3 and 4 describe the data and estimation, respectively. Section 5 discusses the estimation results. The last section concludes. 2.The model 2.1 Structural model Assume that the inflation rate and growth rate in each country are subject to two types of structural shocks as follows xt A0 A1H t A2H t 1 ... A0 ( A1 L0 A2 L1 ...)H t A0 A( L)H t ( A0 ( A1 L0 A2 L1 ...)H t A0 A( L)H t (1), t denotes t), xt ' log cpit (1), ' log gdpt c , and x A A H A H ... where A0 ( A L0 A L1time ...)H(year A0 tor A(quarter L)H t (1), xxt t AA00AA1H1Ht tAA22HHt t 11......t AA000((AA111LL0t0AA222LL1t11...) ...)HHt t A A00A1A((LL)H)Ht t 2 (1), (1), t 0 1 A1H(year ... A0 t), ( A1 L ...)H t ' log A0 gdp A( Lc)H, t and(1), xt A'2 L logcpi H t H dt H st isc the structural shock vector consisting of demand c shock ( H dt ) and suppl 0time t A2Ht t or 1 quarter t t H H st where t denotes time (year t or quarter t), xt c c ' log cpit ' log gdpc ct c , and H t t tdenotes denotes time (year quarter tt), ), xxt t ''log logcpi cpit t ''log loggdp gdpt t ,,,and and HHt t HHdtdt HHstst is the structuraldt shock where where where time(year (yeart tor orquarter quartert), and vector t denotestime tor c c 0 H shock 1H ltime shock vector of demand shock ( H ) and supply ( ). (year t or consisting quarter t ), x ' log cpi ' log gdp , and H x A A H A H ... A ( A L A L ...) H A A ( L ) H (1), ofofconstant Ai are 2×2( Hcoefficient matrices. A( L consistingt oft demand supply vector constant terms, and are 2⊗2 coefficient t2 t 1 ( dt ) and t0 t shock dt ( sttst).A0 0 isisaavector 0 1 t isshock 1 2 t the structural shock vector consisting of demand shock ( H terms, ) and and supply shock st ). isisthe thestructural structuralshock shockvector vectorconsisting consistingofofdemand demandshock shock((HHdtdt))and andsupply shock shock(dt (HHstst).). matrices. cansupply be written in matrix form as follows A(L) is a matrix of polynomials in the lag operator, which lag operator which can be written in matrix form as follows vector consisting shock ( Hmatrices. ( H st 'of ).log c andpolynomials, f shock constant terms, and Ai of aredemand 2×2 coefficient is acpi matrix dt ) and supply t denotes time (year t or xAt ( L) 'shock log H t H dt matrices. H st c where t and t ,2×2 A0 is a quarter vector oft),constant terms, Aigdp are coefficient A( L) is a matrix AA00 isisaavector vectorofofconstant constant terms, terms,and andAAi i are are2×2 2×2coefficient coefficientmatrices. matrices. AA((LL)) isisaamatrix matrix f § f a (i ) Li 1 a (i ) Li 1 · olynomials, which can be written in matrix form as follows 11 ¨ asi follows ¸ 1 i 1 12 constant terms, Ai are 2×2 coefficient matrices. L) is awhich matrix is theand structural shock vector consisting ofA(demand shockcan ( H dtbe ) and supply shock (form H st ). of lag operator polynomials, written in matrix (2). A ( L ) ¨ f ofoflag lagoperator operatorpolynomials, polynomials,which whichcan canbe bewritten writtenin inmatrix matrixform formas asfollows follows f i 1 i 1 ¸ f ¨ ¸ a ( i ) L a ( i ) L i 1 · § f a (i ) Li 1 21 22 a ( i ) L f f i 1 i 1 © ¹ 11 be written 12 matrix olynomials, which form ¨ i 1can i 1in f as follows ff § a (i ) Li 1 a (i ) Li 1 · §¸§ fand (2). A( L) A of constant terms, coefficient ¸ aa11A (i(i)i )Lare Li i 11 2×2 aa¨12(i()i )LiLi 1i 11·11·matrices. iA1( L12) is a matrix ¨ 0 isf a vector f i 1 i 1¨¸¨ (2). A ( L ¸ ¸ i i 11 11 i )i 11 12 f f ¨ ¸ ¨ f ¸ a22AA(i(L)LL f (2). §© i 1aa21((ii))LLi 1 1 i(2). i 1structural i 1a12 ¸21¸ (i )assume (i ) L)i)1 ·¨¹¨ ff We that the shocks H dt and H st have means equal ff ¨ ¸ a L a ( i ) L 11 i i 1 1 i i 1 1 22 ¨ lag ¸¨¨ i 1operator polynomials, i 1 ¸ ¸ of which can be written in matrix form as follows i 1 i 1 a a ( i ( ) i ) L L a a ( i ( ) i ) L L © ¹ A( L) ¨ i 11 2121 i i 11 2222 ©© i (2). ¹¹ f f i 1 i 1 ¸ ¨ ¸ a21 (i ) L H anda22H(i ) Lhave variances equal to unity. In addition, they are mutually independent, f zero iand t the structural to 1 i 1 © i 1shocks §¹ fmeans · dt st (i ) Liequal a12 (i ) L 1shocks We assumea11 that the structural H and H have means equal to zero and A0 A1H t A2H t 1 ... ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ' log cpit ' log gdpt c , and H t H dt H st c where t denotes time (year t or quarter t), xt ' log cpit ' log gdpt c , and H t H dt H st c where t denotes time (year t or quarter t), xt is the structural shock vector consisting of demand shock ( H dt ) and supply shock ( H st ). is the structural shock vector consisting of demand shock ( H dt ) and supply shock ( H st ). A0 is a vector of constant terms, and Ai are 2×2 coefficient matrices. A( L) is a matrix A0 is a vector of constant terms, and Ai are 2×2 coefficient matrices. ATuan ( L) is a matrix (29) 29 Examining the Possibility of Introducing a Common Currency for ASEAN(Vu Khai) of lag operator polynomials, which can be written in matrix form as follows of lag operator polynomials, which can be written in matrix form as follows f § f a (i ) Li 1 a (i ) Li 1 · 0 1 i 1 ¨ i 1 f11 i 1 f12 § xt A0 A1H t A2H t 1 ... A0 ( A1 L A2 L ...)H t AA0 (L)A( L)H t (1), a11 (i ) L a (i ) Li¸1 · (2). ¨ ¨ i1 f i 1 12 i 1 ¸ ¸ (2). (2). A( L) ¨ ¨ f a (i ) Li 1 a (i ) L ¸ © ¨ i 1 f 21a (i ) Li 1 i 1 f 22a (i ) Li¹1 ¸¸ 0 21 22 c c A2H t 1 time ... A0(year ( A1 L A2 L1 ...)tH),t xA0 'Alog ( L)Hcpi (1), i 1 i 1 © ¹ enotes t or quarter ' log gdp , and H H H t t t t t dt st ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ We assume that the structural shocks H dt and H st have means equal to zero and c We assume that H st and have means equal to zero and uctural shock tvector consisting of demand (t H dt structural )Hand andH stsupply shock Hequal (dtH st and ). to zero ar t or quarter ),Wextassume ' logthat cpit the ' log gdpt c , shock and Hthe structural shocks haveshocks means variances equal to unity. In addition, they dt variances equal to unity. In addition, they are mutually independent, and serially are mutually independent, and serially uncorrelated at all leads and lags. With these assumptionsand we can write variances equal to unity. In addition, they are mutually independent, serially uncorrelated atsupply all leads and(lags. assumptions we can write ector demand ( H2×2 shock H st ).A(With ector consisting of constantofterms, andshock Ai are coefficient matrices. L) isthese a matrix dt ) and uncorrelated at all leads and lags. With these assumptions we can write § § 0· §1 0·· rator polynomials, which can be written in matrix as follows H t 㨪 ¨¨ ¨ § §¸0; ¨· § 1 ¸0¸¸ · · (3). (3). t terms, and Ai are 2×2 coefficient matrices. A( L) form is a matrix Ht 㨪 (3). © © ¨¨0¨¹ ©¸0; ¨ 1 ¹ ¹ ¸ ¸¸ f 0¹ ©0 1 ¹¹ i 1 · © § f a (i ) Li 1 © a (i ) L ls, which can be written ¨ i 1in11matrix formi 1as12follows¸ (2). A( L) ¨ 1 f f x Bi 11xt¸¸1 B2 xt 2 ... B p xt p et B0* > I B( L) L @ et B0* C ( L)et (4). t aB0(i) L ¨ f a21 (i )iLi11· i 1 § f a (i ) L2.2 1 22 * * Estimated model i 1 i 1 © ¹ a12 (i ) L 11 x B B x B x ... B x e B I B ( L ) L e B C ( L ) e (4). 1 > @ * * ¨ i1 i 1 t 0 1 t 1 2 t 2 p t p 1 t xt ¸B0 tB xt ... B t > I B0B(*L) L )0et* C(4). (2). L) ¨ B 1 0BB 2 xtxt 21*... p xt1 xtis B2 xBt p2bivariate eBt p xVAR I@ 1eBt ( L)BL0@*eCt ( LB ( L)et (4). ¸Bmodel 0 as >follows t 0p * e t f f estimated The areduced-form model i 1 are xit1Here B21xtB B vectors *B ( L) L @ elements, et B01 C (BLi)*0et( i 1,..., (4). p ) are 2×2 ¨ ¸ 0 BB 0t 1and 0 > Iconstant 1x 20 ... p xt p et of Btwo a ( i ) L a ( i ) L 21 22 B B x B x B * > I B( L) L me ©thati 1the structural means equal to zero and i 1 shocks ¹H dt xandB Hst B have 1 > I *B ( L ) L @ ext 1 ... B p* xt p et * x B x ... B x e B B C ( L ) e (4). 0 1 t 1 2 t * * 0 t e B(4). 0 ... 1 1 xare 2 t 2vectorsBpof tIB Bt B p ()L)are xt B0 BHere xt 1 tB20xt and ptwo Bt (1Lt )constant LB@20xtet2 B...0elements, BCp x( L I tB L @2 e2×2 B0 C ( L)et 0(4). > are i B(0 i 1,..., 0 0 > t t p* t p etofxt B 1x t )pe t 1,..., and BB0*2and are B0vectors two constant elements, B ( i p ) 2×2 Here B10Here i are vectors of two constant elements, Bi ( i 1,..., p ) are 2×2 0 * matrices, 0 c is* the vector egdp In coefficient and and B0mutually ofet ...two constant (1ieerror 1,..., 2×2addition, Here Bthey suctural equal to unity.H In and addition, are serially 1(ecpi and ,t ,t ) elements, Be0equal are BB1 x**t vectors >independent, BHere ( LB)iL @of B0*pterms. )CBare ( L* )eare (4). (4). t 1to t (2Land p xtB p* t ( L )Be0 > I(4). xshocks B0 B1dtxt 1 B2 xHt st 2 have ...0 *Bmeans xBxt t p IBzero 2 xBvectors ) L @ eBof * eC Bt0Bi and vectors and B are two constant elements, ( terms. i 1,..., are 2×2 of two constant eleme Here 0 0 t t t p t 0 p c 0 0 econstant is the vector of error In) addition, matrices, and Bcoefficient andcoefficient B0 matrices, are vectors of two and B vectors B ( i of 1,..., two p ) constant are 2×2 elements, Bi ( i 1,..., p ) are 2×2 Herelags. Here t B0(ecpi ,tc eelements, gdp ,t ) are ated at all leads and these assumptions we can write 0 With i 0 et and (ecpi ,of egdp the)in vector ofvector error ofterms. In addition, andmatrices B( L) , C ( L) matrices, are the lag operator, which can be written as c t et polynomials t ) ,t isegdp (e,cpi is the error terms. In addition, coefficient ,t c is the *e y. In addition, they *arecoefficient mutually independent, (serially ecpi egdp ,t )of vector of error terms. matrices, and t are ,t polynomials and B0and two constant elements, Bi matrices, (In i addition, 1,..., ) are Here * Bfollows , of C·(BL are matrices ofevectors the operator, which can beInpwritten as 0) matrices, §)Bvectors ·matrices 0 e 2×2 (ecpi ,t egdp ,t )c is the vector coefficient and c 1,..., §,00 ·(are §()L1)vectors B0B0 and are two constant elements, BB (( ,it lag p lag are 2×2 Here B0 and Here of two constant elements, ))lag are 2⊗2 coefficient matrices, and ( e )in is the vector of error terms. addition, coefficient and ie B ( L C L are of polynomials in the which can written as i t cpi , t gdp c c be L) ,can C the operator, canvector be written as terms. In addition, and lags. With these assumptions H t 㨪 ¨¨matrices, ;B¨ (we (3). eare (ematrices egdp ,tof ) polynomials is the vectorinand ofoperator, error et (terms. ecpi egdp In )addition, is the of t error coefficient and matrices, ¸¸( L)write ¨ ¸ ¸ t cpi ,t coefficient ,t ,twhich follows B( L©)of , C ( L ) are matrices of polynomials in the lag operator, which can be written as 0 0 1 is the vector error terms. In addition, and are matrices of polynomials in the lag operator, which can be B(L) © ¹ © ¹¹ p follows 1 ithe i)1, C §eC(L)p eb (in ·which B () L ( L) are matrices of polynomials in the lag opera follows B ( L ) , C ( L ) are matrices of polynomials lag operator, can be written as c i ) L b ( i L e ( ) is the vector of error terms. In addition, coefficient matrices, and 11 12can be¸ written § § 0matrices, c t (the cpi ,t i 1operator, gdp ,t · §B1( L)0, ·C·(follows L) are matrices of polynomials B ( L ) in , C L ) lag are matrices of which polynomials in the lag as operator, which can be written as e ( e e ) is the vector of error terms. In addition, coefficient and ¨ 1 i p p t cpi ,t gdp ,t as follows 1 1 i i § · , B ( L ) H t 㨪 ¨¨ ¨ ¸written ;¨ (3). ¸ ¸¸ p b (i) Lp ii11 ) L ii11 ¸ follows ¨ pb12 (ifollows § i i p11 · follows b11¨ §(¨i) Lii p1p1 11 (i) Llag © 0 ¹ follows ©0 1 ¹¹ B( L) , C ( L) are matrices the b21((can boperator, L ¸ ·¸ , which can be written as ii))iin LL p1 b12 Li )p1polynomials 22((ii))L ¨ B(of i 1 b11 i 1¸b12 B( L) , C ( ©L) are matrices of polynomials in the be(iwritten ¹ ¨11¨©(i )which p ii 11 p ii 11 · , as b L b ) L B( Llag ) ¨§¨operator, p p 1 i i 1 ¸ ¸ , p p 12 B ( L ) § ¸ 1 1 ·¸ i i ¨ ¸ 1 1 i i p p § b ( i ) L b ( i ) L b (i) Li 1 b (i) Li p p p p follows p11b¸22 21(i ) L i i 1b1· (i ) L i 1 · § B( L) b¨¨(i ) Lip1b21 §(i(,)iL) Li b¸1¹ ¸¸(i ) Li 1 i i © ¨¨(i ) Lii i 1p11bb11 follows 12 ¨ i 1 11 i 1 12 ( i ) L b ( i ) L ¨ 1 i ¸ 22 b ( i ) L b p 11 12 11 12 1 1 i i B ( L ) ¨ i 1 ©¨B( L) b¨ ©(i ) Li ii 111 21 ¸p (i ) Lii 11¹¸¨i22 i 1 ¸p¹ , ¸ i 1 ¨ b p p ,( Lp) p ¹¨ , ¨ B ( L) ¨ i 1 i 1 21§ pp p § 1 ii1i11¸22Bb (i i1) Li · p b (i ) Li 1 b (i ) Li pp © p ¨ b b¨11 (i )(iL) Li 1p ¸i 1 22 (ib) L i 1 ¸ b(i )(iL)pLipb¸¹1i ·1(bi12 § i 1 22 © i 1 21 (i ) L b (i) Li 1¨ C ( L)b21 b (i()iL)iLi11©1·¨ i 1i b1§2122 i 1i i122¨12 ¸ )(Li ) Li · ¸ i 1 b22 (i ) L ¸¹ 21b ¨ i 1 11 1 i i1 1 12B ( L) § ¸ i 1p 1¨ i p © ¹ © b ( i ) L , ¸ p det I 11¸B B ( L) ¨ ¨(,L) pL¨ §b122(i ) Liipi1p1 bb22 (i()iL pi ib 1 ) Lii p1 ¸·12 b(i )(Li )i L¸i ·¸ 12 (i p C ( L) p 1 ¨11¸¨ i ¨p1b¨¨©21 (i ) Li i1 2122 )i Lp1b22 (i ) Li ii1p1¸¸ib·12 1 11 ¹ ¨ bC (i )ILi ¨1§B ( iL))Li 1 C ( L) 1bdet p i 1 b22 (ip)pLi 1 ii 1 b12 (i ) L i ¸¸ ( ) © ¹ L L p 21 22 §1 ¸ i © i 1 C ( L) det I i1B( L) L p ¨ ¹ p i§¨i 1¨1 i ppb21 (i()iL) Li ii p1 ·1 §ibp¸b11 b (i ) Li p (i )(iL)ipL ·¸¹i ¸ §1det ( L(i))LpL¨©b¨21 (i ) Li i1 1bbb22 I 1¨¨ B i 1¸ 12 1 ( ) b i L i 1 22 b ( i ) L 1 b ) L(i L) b121(i ) Li · ¨ ¸ ¸ i 1 ¸ 11 i ) L 1i p1¸ 1 ¨ i¹ b11 (ii )1L 22 (iC det 1C ( L)I ¨B( L) L i ©¨1 22 i 1¨b© (i ) Lii i 11 21121( ¸ i 1 b11 (i ) Lp i ¸1 p ¸¹ C ( L) C ( Lp) p det pI B( L) L¸ ¨¨ I p B ©p ( L) Lii 1¨ i§21 1 b (i ) Li p ( L) L ¨det (bi ) LI(ii) LBii (1¸¸1L) L ¨¨ ¹b11 (pi ) Lii ¸ · i b pdet i i det §1 I B i 1 21 © 0 b 1 ¨ 11· ¨ ¸ ( ) ( ) ( ) 1 ( ) b i L i L b i L b i L b ( i ) L ( i ) L 1 i 1 i211 b22 i 1 12 © ¹ ¸ 21 11 21 11 22 12 I ( C L C L ...) H (5). 1 ¨ ¸ t i1 i 1i 1 i 1 i 1 i 1 C ( L) © ¹ © ¹ 2 (5). C ( L) ¸ p p i det ( LL ) 1L¨¨...) p (C1I1L00BpC i ¸H t det I B( L) L ¨¨ 1 b11 (i ) Li ¸ 21 (i ) L ¸ i 1 b(5). )1Li0I I i 1 terms. ¹ We assume that I b21((Ciidentify C12(C Lstructural ...)Hb211 (1i )©L(5). Our task is shocks from the error (5). i 1 to © ¹ Ht 11L i1Ct2 L ...) 0 I (Cshocks L 0 ...)the H t1 error (5). terms. We assume that demand and supply 0shocks1 enter 1 L Cstructural 2 from Our task is to identify structural Our task is to identify shocks from the error terms. We assume that demand and supply shocks enter the error terms in a linear form. Thus the vector L of C2 L ...)H t (5). C L ...) H t the (5).error 1 I (C1 L Our taskOur is to structural shocks from terms. assume thatI (C1that I identify (C1is L0 to Cidentify (5).2 I from (C1 L0 the C L1 ...)We Hterms. (5).We assume task shocks 2 L ...)H t structural 2 error t demand and supply shocks enter the error terms in a linear form. Thus the vector of D and the the error terms in a linear form. Thus the vector of error terms can be written as a product of a 2⊗2 matrix error terms can be written as a product of athe 2×2 matrix D and the structural shock Our task is to identify structural shocks from error terms. We assume that demand demand and supply shocks enter the error terms interms afrom linear the vector 0 1 shocks OurThus task isThus to assume identify structural shocks from the e supply shocks in linear form. theofvector of task is to identify structural theaform. error terms. We that 0Our 1 and IOur the (as Center Laerror Cthe error ...) H ta terms can be(5). written product oferror matrix and the structural shock 1task 2 Lterms vector Our demand task to structural shocks from is the to identify terms. structural WeDassume shocks that from the of error terms. We assume that I terms (is Cerror identify C ...) Hshocks and supply enter in2×2 a(5). linear form. Thus the vector structural shock vector 1L 2 L be t error written as a product of a error 2×2ofmatrix D aand the structural shock demand andthe supply shocks enter the error terms in a lin errorcan terms can be shocks written as a product a 2×2in matrix D form. and structural shock demand and supply enter the terms linear Thus the vector of vectorcan demanderror and supply shocks enter demand error terms and ofsupply in linear shocks form. enter Thus the the error vector terms of inshock a linear that form. Thus the vector of be written as a product aa 2×2 matrix Dthe and the structural Our task is to the identify structural from error terms. We assume vector terms et shocks D Hat 2×2 (6). error canstructural be written as a product of a 2×2 matrix Our task is to identify structural theas error terms. We assume that vector error termsshocks can be from written a product of matrix D terms and the shock error terms candemand be written as a product error of terms a 2×2 can matrix be written as a product of a 2×2 matrix D and the structural shock D and structural shock vector enter the in a linear form. Thus the vector of the (6). e error D H t terms (6).vector vector demand and supply shocks vector enter the and errorsupply termsshocks in a linear Thus the of et Dform. H t te (6). Given (3) and (6), it follows that D H (6). vector vector terms of cana be product oft a 2×2 matrix e Da D H t tthe (6). error terms can be written aserror a product 2×2written matrixas and structural shock D and the structural shock Given (3) and (6), it follows thatt et DH t (6). et DH t (6). vector c c Given (3) and (6), it follows that e D H (6). (6). c c et(7).DH t E ( e e ) DE ( H H ) D DD ¦ vector Given (3) and (6), it follows t t ethat t t t t Given (3)Given and (6), follows (3)itand (6), itthat follows that c DDcGiven E (et etc ) ecDE (DHHt H tc ) D(6). ¦ethat (7).(3) and (6), it follows that Given (3)eandD(6), follows t)DE t H c )c Dthat E (et ¦ etc )(3)EDE D H t it¦(6). Given (3) and (6), it follows that and itc follows c (7). e Given tH (et(eHtc(6), ) t However, (HDD DDc¦ (7). t ec t t c We obtain ¦e¦efrom since is a 2×2 symmetric matrix c c E (eestimation. e ) DE ( H H ) D DD (7). e t t t t DE (H t H tc ) Dc DDc ¦e E (et etc ) (7). c DDc¦ c is Ec(et ectc ) However, DE (H t H tc ) Dsince ¦e that (7).a 2×2 c symmetric Given (3) and (6), it follows We obtain ¦ from estimation. c c e e Given (3) and (6), it follows that E ( e e ) DE ( H H ) D DD E ( e e ) DE (H t H t ) Dc matrix DDc matrix ¦ ¦ (7). (7). e t t t However, t e is at 2×2 t We obtain from since we ¦esince symmetric e contains while D four unknown elements, need to impose one more condition to We ¦ obtain ¦estimation. from estimation. However, ¦ is a 2×2 symmetric matrix e We obtain ¦e from eestimation. However, sinceH c )¦Dec isDD a c 2×2 symmetric matrix c DE E (ehere ¦ cobtain c )one while four unknown elements, need restriction, to one more condition to e (7). t et )However, twe t since We obtain ¦esays from estimation. However, since ¦e identify D . (The impose is a(Hlong-run which that in the celements, Econtains (et etD ) contains DE H¦t Heunknown Dc we DD ¦eD We from estimation. ¦e impose is (7). amore 2×2 symmetric matrix t while four we need to impose condition We We obtain ¦e from from estimation. However, since ¦e ¦isfrom aestimation. 2×2 symmetric However, matrix since ¦to 2×2 while D estimation. contains four unknown elements, we need to one impose one more condition to symmetric matrix We obtain obtain identify However, since 2⊗2 symmetric matrix while e ais e is afour D contains D . four The one we impose here we is aneed long-run restriction, which says that in the unknown while D contains unknown elements, to impose one more condition to identify Dto. impose The one weGDP impose here is ahere long-run restriction, which that in the long run is not affected by demand shock ( HDadtsays ). This means that the elements, while contains four unknown identify Dreal .one The one we impose isthe aD.long-run restriction, which that in the elements, we need more condition to The one we impose here is asays long-run restriction, which we need to i while D However, contains four unknown elements, we need to impose one more condition to from estimation. However, since ¦elements, 2×2 symmetric matrix e iscondition We obtain ¦e from estimation. since ¦e Dwe isis aidentify 2×2 matrix while while Didentify contains four unknown elements, contains tosymmetric four impose unknown one more wethat need to impose one more condition to D .We Theobtain one GDP we¦eimpose here aneed long-run restriction, which says into the long run real is not affected by the demand shock ( H ). This means that the dt which identify D . The one we impose here isofaalong-run restri identify D . The one we impose here is a long-run restriction, says that in the long run real GDP is not affected by the demand shock ( H ). This means that the says that inDthe long run realreal GDP ishere notis affected by demand shock This means thatThis the cumulative effectsays dthere cumulative effect of aidentify demand shock on GDP level at infinity zero. cumulative long run GDP not by the demand shock ( Hthat ).long-run This means that the identify . The one we is a affected long-run D . the The restriction, one we impose which says is ais in the restriction, which that in the D impose contains unknown we need one more to longunknown runwhile realelements, GDP is not affected by theelements, demand ( H dtto).toimpose Thisdt means that condition the while D contains four we four need to impose one moreshock condition cumulative effect ofofis athe demand shock on GDP level at infinity is zero. This cumulative long run real GDP is not affected by the demand shock effect is the sum effects of the demand shock on the first-difference of GDP (i.e. demand cumulative shock on GDP level at infinity is zero. This cumulative effect is the sum of the effects of the demand shock on long run real GDP not affected by the demand shock ( H ). This means that the identify D one we impose here is GDP ais long-run restriction, which says that (in effect of.effect aThe demand shock onreal GDP level at infinity is zero. This cumulative longone runwereal GDP is not long the run demand GDP shock (not by dtthe demand shock H dtlevel ).affected This means that theThis H dt the ). This means that the identify D . The impose here is aaffected long-run restriction, which says that in the cumulative of aby demand shock on at infinity is zero. cumulative effect is the sum of the effects of the demand shock on model, the first-difference ofcase GDP (i.e. growth rate) in each period. Thus, from the structural itThis must beitthe that cumulative effect of a demand shock on GDP level at infinity is zero. cumulative the first-difference of GDP (i.e. growth rate) in each period. Thus, from the structural model, must be the case that effect iscumulative the sum ofeffect the effects ofeffects the demand shock on theatfirst-difference of This GDP (i.e. cumulative effect of a shock on GDP level at infi effect is the sum of athe of theon demand shock on the first-difference ofdemand GDP (i.e. of demand shock GDP level infinity cumulative long real GDP is not affected by the demand shock (it His ).zero. This means that the dt growth rate) in each period. Thus, from the structural model, must beGDP the that is long run realcumulative GDP is noteffect affected byof the demand shock (level H dteffect ). at This that the of sum arun demand shock cumulative on GDP of infinity ameans demand isthe zero. shock Thison cumulative GDP level atcase infinity zero. This cumulative effect is the the effects of the demand shock on first-difference of (i.e. growth rate) in each period. Thus, from the structural must be the case that * * fmodel, iteffect § · is the sum of the effects of growth rate) in each period. Thus, from the structural model, it must be the case that effect is the sum of the effects of the demand shock first-difference of GDP (i.e. the demand shock on th Afrom (is L)the orthe a21 (i )on 0the (8). effect isgrowth the sum of the effects of the effect demand shock sum on of the first-difference effects of the demand of GDP shock (i.e. on the first-difference of GDP (i.e. ¨ ¸ rate) in each period. Thus, the structural model, it must be the case that i 1 cumulative effect of a demand shock on GDP level at infinity is zero. This cumulative * * f cumulative § © 0from growth period. Thus, from the structural mod cumulative effect of a demand shock on in GDP level at is ·*zero. ¹ the This growth rate) each period. structural itrate) mustin beeach the case that *A(infinity *)structural § the ·rate) LThus, a21must (Thus, i ) model, 0be (8). *¸ each ¨or §0* the ·for growth rate) in each period. Thus, from growth in model, period. it from the case the structural that model, it(i.e. must be the case that i f 10 A ( L ) a ( i ) (8). effect is the sum of the effects of demand shock on the first-difference of GDP * ¸ ¨ *A(the (i ) 0(i.e. (8). ¹ ¸i f1 or21 effect is the sum of the effects of the demand shock¨§on ofa GDP *L*¹)·¸ ©first-difference i 1 21 (8). A(6) ( L)we©¨0have f *· ¹i 1 athe From (4), (5),in and § * *· *© 0 *from f 0 21 (i )structural §or growth rate) each * ·(8). it must A(that L) ¨ a (i ) 0 f it must f be the case § * *period. · ©A0model, §0*model, growth rate) in each period. Thus, from the structural ( L)*Thus, or be the acase (i ) that ¸ or ¹ ¨ ¸ 21 i 1 21 From (4), (5), have A( Land ) ¨(6) we or a ( i ) 0 (8). or a ( i ) 0 (8). i 1 A( L ) ¨ 0 * ¸ ¸ 0 * 21 21 © ¹ i 1 From (4),From (5), and have 0(6)*we 0 *¹ (4), (6) (5),we and have i ©1§ * ¹* · © ¹ © f * · (6) we fhave § * and From (4), (5), a (i ) 0 (8). ¨ ¸ or A( LFrom ) ¨ (4),¸(5), or and (6)a21we (i ) have 0A( L) (8). i 1 21 From (4), (5), and (6) we have *¹ i 1 © 0 and * ¹ have From (4), (5), and (6) From (4), (5), (6) we have © 0 we 4 4 From (4), (5), and (6) we haveFrom (4), (5), and (6) we have ¦ ¦ ¦ ¦¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦¦ ¦¦ ¦ ¦ ¦ ¦ ¦ ¦¦ ¦¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦¦ ¦ ¦¦ ¦ ¦ ¦¦ ¦ ¦¦ ¦ ¦ ¦ ¦ ¦¦¦ ¦¦ ¦ ¦¦ ¦¦ ¦¦ ¦ ¦ ¦ ¦ ¦ ¦¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ while D contains four unknown elements, we need to impose one more condition to identify D . The one we impose here is a long-run restriction, which says that in the long run real GDP is not affected by the demand shock ( H dt ). This means that the 30 cumulative effect of a demand shock on GDP level at infinity is zero. This cumulative effect is the sum of the effects of the demand shock on the年 first-difference of GDP (i.e. 横浜国際社会科学研究 第 13 巻第 1・2 号(2008 8 月) growth rate) in each period. Thus, from the structural model, it must be the case that (30) § * *· A( L) ¨ ¸ or © 0 *¹ ¦ f a (i ) i 1 21 0 (8). (8). From (4), (5), and (6) we have From (4), (5), and (6) we have B0* C ( L)( DH t ) xt Note that (9)xis t B0* C ( Lform )( DH tof ) another B0* D4H t (C1 L1 C2 L2 ...) DH t (9). 1 2 B0*structural DH t (C1 L C2 L(1). ...) DH t (9). the model Compare (1) Note that (9) is another form of the structural model (1). Compare (1) and (9) to have (9). and (9) to have Note that (9) is another form of the structural a12 (1)(1). § a11 (1) model · Compare (1) and (9) to have 2 xt B0* C ( L)( DDH t ) A1B0*¨ a D(1) H t a(C1(1) L1 ¸ C2 L(10). ...) DH t (9). § a11©(1)21 a12 (1)22· ¹ (10). D A1 ¨ ¸ Note that another of the ©in structural model (1). Comparecan (1) and (9) to have (1) the (1) a21(5), a22long D (9) in is (10) and Cform ( L) given restriction be written as With ¹ run (10). f a11ª(1)long a f (1) · restriction º a (1) can written as With D in (10) and ªC ( L) bgiven (i ) Li ºina (5), (1)§ the 1 12run b (i) Li(10). 0 be(8’). ¬« i 1 21 D ¼»A111 ¨ a ¬«(1) a i 1(1)22¸ ¼» 21 21 22 © ¹ f f With D in (10) and C(L) given in (5),ª the long be written as(1) 0 b (irun ) Li º restriction a (1) ª1 can ) Li º aable (8’). 22 (iare Having four equations (8’),i 1 bwe « i 1 21 from » 21 to identify the four unknown ¼» 11(7)inand ¬« the (5), long run¼ restriction can be written as With D in (10) ¬and C ( L) given elements of D and thus recover structural shocks. Having four equationsf from (7) and (8’), wef are able to identify the four unknown ª b21 (i ) Li º astructural (1) ª1 shocks. b (i) Li º a21 (1) 0 (8’). (8ʼ). elements of D and«¬ thus i 1 recover i 1 22 »¼ 11 «¬ »¼ 2.3 The AD-AS model Having four equations from (7) and (8’), we are able to identify the four unknown Having four equations from (7) and (8ʼ), we are able to identify the four unknown elements of D and thus recover 2.3 The AD-AS elements of D model and thus recover structural shocks. [Figure 1 about here] ¦ ¦ ¦ ¦ ¦ ¦ structural shocks. [Figure 1 about here] The AD-AS model The explanation of the AD-AS (Aggregate Demand-Aggregate Supply) model is given 2.3 The AD-AS model in detail in Dornbusch et al. (2001)8. Here we use it to see the responses of the price The explanation of the AD-AS (Aggregate Supply) model is given [Figure 1Demand-Aggregate about here] level (P) and real GDP (Y) to (positive) demand and supply shocks in the short run and in detail in Dornbusch et al. (2001)8. Here we use it to see the responses of the price long run. The explanation of the AD-AS (Aggregate Demand-Aggregate Supply) model is in given in detail inand Dornbusch et levelThe (P) and real GDP (positive) demandDemand-Aggregate and supply shocks Supply) the short run explanation of(Y) theto AD-AS (Aggregate model is given 8) Figure 1 shows the AD-AS model. The AD line is downward sloping, the short run AS supply al. (2001) . Here long we use it to see the responses of the price level (P) and real GDP (Y) to (positive) demand and run. in detail in Dornbusch et al. (2001)8. Here we use it to see the responses of the price (SRAS) is upward sloping, and the long run AS (LRAS) is vertical. Suppose that the shocks in the short level run and run. Figure 1 shows AD-AS Thedemand AD line and is downward sloping, (P)long and real the GDP (Y) tomodel. (positive) supply shocks in the the short short run runAS and economy is in equilibrium at the intersection of AD, SRAS and LRAS (point E ). is upward sloping, and the long run AS (LRAS) is vertical. Suppose that the sloping, Figure 1 shows(SRAS) the AD-AS model. The AD line is downward sloping, the short run AS (SRAS) is upward long run. When a demand shock occurs, the AD line shifts upward. From the graph on the left is in equilibrium at themodel. intersection AD, SRAS and LRAS (point E ). run Figure 1isshows theSuppose AD-AS ADofline downward sloping, the short and the long run economy AS (LRAS) vertical. that theThe economy is isin equilibrium at the intersection ofAS AD, SRAS When asee demand occurs, line shifts upward. the graph on the we canis that inshock the short runthe theAD price level up and real GDP increases ( E left ńthe A1 ), (SRAS) upward sloping, and the long run ASgoes (LRAS) isFrom vertical. Suppose that 2.3 and LRAS (point E). economy is in equilibrium at the intersection of AD, SRAS and LRAS (point E ). When a demand shock occurs, the AD line shifts upward. From the graph on the left run the price level goes upthe andlong GDP (E→A the run longlevel run real gets back the long run while run, GDP gets back to theinlong and GDP the price level to goes 1), while up in further (real A1 ń A2 real ). increases can seeup that in the run the price level goes up and real GDP increases ( E ń A1 ), level and the price we level goes further (Ashort ). →A 1 2 up further ( Aa A2 ). shock 1ń When supply occurs, the AS line shifts downward. From the graph on the When a supply shock ASreal lineGDP shiftsgets downward. From therun graph onand the the rightprice we observe that in the while in occurs, the longthe run, back to the long level level goes right we observe that, in the short run the price level goes down and real GDP increases When a supply shock occurs, the AS line shifts downward. From the graph on the short run the price level goes down and real GDP increases (E→B1), and in the long run these effects proceed further up further ( A1 ńthat, A2 ). in the short run the price level goes down and real GDP increases right observe ( Ewe ńB 1 ), and in the long run these effects proceed further ( B1 ń B2 ). we while can see that the short run the price level goes up andrun real GDP increases (see E level ń A1 ), inoccurs, the in long real GDP gets back to the long and thecan price goes When a demand shock therun, AD line shifts upward. From the graph onlevel the left we that in the short (B1→B2). When a supply shock occurs, the AS line shifts downward. From the graph on the right we observe that, in the short run the price level goes down and real GDP increases 9) to note here. First, as awhose definition, a supply (demand) shock is supply a shock whose first definition, a supply (demand) shock shock firstconsider impact isstructural a shift in the aggregate (demand) Now at the endisofa this section we shocks. There are some pointscurve . We 9. We have seen above how AD impact is a shift in the aggregate supply (demand) curve ń Band ), and in theaslong run these effects proceed further ( B1 ńisBa 1here. 2 ).shock whose first to( Enote a definition, a supply (demand) shock have seen above how AD ASFirst, curves shift when shocks occur. and AS curves shift when shocks occur. impact is a in the aggregate supply (demand) curve9. in We haveThere seen above howpoints AD Second, we keep in mind the behavior of the central in each country response to shocks when decomposing Now atshift the end of this section webank consider structural shocks. are some Second, we keep in mind the behavior of the central bank in each country in and AS curves shift when shocks occur. noteand here. First, as a into definition, aand supply (demand) shock is athat shock whose first the movements in to output the price level supply demand parts. We assume the central response to shocks when decomposing the movements in output and the price levelbank in toderives Second, we keep in aggregate mind the supply behavior of the curve central bank inseen eachabove country in 9. We impact is a shift in the (demand) have how AD its optimal monetarysupply policy and to minimize quadratic function inflation gapbank and output terms of their demanda parts. We loss assume thatof the central derivesgap itsinoptimal response to shocks when decomposing the movements in output and the price level in to and AS curves shift when shocks occur. monetary policy to minimize a quadratic loss function of inflation gap and output gap equilibrium levels. The central bank will act to smooth out the movements of both inflation and output. Theinoptimal supply and demand We the assume that ofthe optimal Second, we keep parts. in mind behavior thecentral centralbank bankderives in eachitscountry in of their equilibrium levels. TheIncentral bank will actshock, to smooth out the monetary policy monetary willterms differpolicy depending on the type of shocks. the case of a demand for example to minimize a quadraticthe lossmovements function ofin inflation output gapinintoa sudden response to shocks when decomposing output gap and and the price level terms of and theirdemand equilibrium levels. The central bank will actandtoderives smoothits the and the decrease in private consumption, the AD parts. line shifts causing both output inflation toout decrease, supply We downward assume that the central bank optimal E ńof BNow ), and in long run these effects proceed further ( Bshocks. ń B2 ).points 1 this 1 some at thethe end ofconsider this section we consider There to arenote some points Now at the (end section we structural shocks.structural There are here. First as a monetary policy to minimize a quadratic loss 5function of inflation gap and output gap in terms of their equilibrium levels. The 5 central bank will act to smooth out the 5 Examining the Possibility of Introducing a Common Currency for ASEAN(Vu Tuan Khai) (31) LRAS P P ADʼ A2 AD AD LRAS 31 LRASʼ E SRAS B2 A1 B1 E SRAS SRASʼ Y Y Response to a demand shock Figure 1 Response to a supply shock The AD-AS model and the responses of the price level and GDP to shocks central bank will react by a monetary loosening. In the case of a supply shock, for example sudden rise in oil price, the AS line shift upward, output decreases while inflation goes up, the central bank faces a trade-off and will respond with a tightened monetary policy to cool down inflation at the expense of output. In the literature, some authors regard only the correlations of supply shocks are important because they consider most of the demand shocks are monetary ones, and that once the monetary union is formed these shocks will be automatically synchronized. To a certain extent I agree with this view, but I think that demand shocks other than monetary ones such as shocks to private consumption or investment are also important, and they may not necessarily be synchronized even when the monetary union is formed. Hence, correlations of both demand and supply shocks are important when considering forming a CCA10). The third point is that, to identify the structural shocks we assumed that there are two kinds of shocks based on their effects on output, i.e. the one that lasts long (permanent) and the other that is short-lived (temporary). They are named supply shock and demand shock, respectively, because it is widely assumed that supply shocks are permanent while demand shocks are temporary. In reality, however, as well-recognized in Bayoumi and Eichengreen (1994), there might be long-lasting demand shocks as well as short-lived supply shocks. In such cases the method used here cannot correctly identify demand and supply shocks. Admittedly, this is the limitation of the method. The impulse response functions will help us to see this. 3.Data Real GDP and CPI data of ASEAN countries were used for the analysis. Due to the constraint on data for ASEAN 横浜国際社会科学研究 32 (32) 第 13 巻第 1・2 号(2008 年 8 月) countries, two data sets were collected and used. Quarterly data were available for only six ASEAN countries which are referred to as ASEAN-6 in this paper. The sample periods are as follows: 1993Q1─2004Q2 for Indonesia (INA), 1980Q1─2004Q2 for Malaysia (MAL), 1984Q1─2004Q2 for Singapore (SIN), 1993Q1─2004Q2 for Thailand (THA), 1981Q1─2004Q2 for the Philippines (PHI) and 1989Q1─2004Q2 for Vietnam (VIE). data sources are the websites of the Asia Regional Information Center (ARIC), ASEAN, The other set contains annualfordata nine ASEAN countries. Here this group is denoted ASEAN-911). The the data International Centre theofStudy of East Asian Development (ICSEAD), central re the websites of the Asia Regional Information Center (ARIC), ASEAN, ation Center (ARIC), 12. Philippines, Malaysia, and Myanmar (MYA), sampleASEAN, periods areand 1976─2003 fordepartments Indonesia, Singapore, banks statistical of ASEANThailand, countriesthe nal Centre for the Study of East Asian Development (ICSEAD), central velopment (ICSEAD), central Before being theand quarterly data were seasonally adjusted using 1981─2003 for Vietnam, 1980─2003 forestimation Laos (LAO) Cambodia (CAM). 12. used for istical departments of ASEAN countries data sources are the websites of the Asia Regional Infor Asia Regional InformationCensus Center (ARIC),procedure. ASEAN, Together with annual data, their were2004, ADB Key These data wereX-12 collected from variousadjusted sources,using mainly IMF International log-differences Financial Statistics gere used for estimation the quarterly data were seasonally the International Centre for the Study of East Asian D seasonally adjusted using udy of East Asian Development (ICSEAD), central Together with annual data, log-differences were'other Indicators 2004, and UN Statistical Yearbook The data sources are and the websites ofdepartments the Asia Regional calculated. The twotheir variables ' log2004. cpit and log gdp be approximately considered t can banks statistical of ASEAN countries1 ,fprocedure. their log-differences were ASEAN countries12. Information Center (ARIC), ASEAN, the International Centre for the Study of East Asian Development (ICSEAD), Before being used for estimation the quarterly data two variables ' log cpi and ' log gdp can be approximately considered the quarterly data were seasonally adjusted using t as inflation t rate and growth rate, respectively. n be approximately considered 12) Census X-12 procedure. Together with annual da statistical departments r with annualcentral data,banks theirandlog-differences were of ASEAN countries . e and growth rate, respectively. Before being used forconsidered estimation the quarterly data were seasonallycalculated. adjusted using Census X-12 procedure. The two variables ' log cpit and ' log gdpt c cpit and ' log gdpt can be approximately spectively. on Together with annual data, their log-differences were calculated. The two variables ∆ log cpit and ∆ log gdpt can be 4. Estimation approximately considered as inflation rate and growth rate, respectively. as inflation rate and growth rate, respectively. Estimation was done using Eviews 4.1. The lag length for the reduced-form VAR 4.Estimation model is chosen as follows. At first, SBC Criterion) and AIC (Akaike 4. Estimation wasfordone Eviews VAR 4.1. The lag length for the reduced-form(Schwarz-Bayesian VAR th the using reduced-form Estimation was doneCriterion) using Eviews 4.1. The lag length for the reduced-form VAR model chosen as follows. Information were used to select the most appropriate VAR model, but is these n follows. At first, (Schwarz-Bayesian Criterion) and AIC (Akaike anasCriterion) and AICSBC (Akaike two criteria often suggested different lag lengths. Thus, the author decided to set the At first, SBC (Schwarz-Bayesian Criterion) and AIC (Akaike Information Criterion) were used to select the most riterion) weremodel, used to select the most appropriate VAR model, but these Estimation was done using Eviews 4.1. The lag le opriate but these ews 4.1.VAR The lag length for the lag reduced-form VAR same length for all countries in each data set. Specifically, the lag length was one appropriate VAR model, but these two criteria often Thus, the authorfor decided to set the en suggested different lagthe lengths. Thus, the author decided to suggested set the different lag lengths. model is chosen as follows. At first, SBC (Schwarz-Baye the author decided to set SBC (Schwarz-Bayesian Criterion) anddata AICset (Akaike the annual (ASEAN-9), and four for the quarterly data set (ASEAN-6). h for all countries in each data set. Specifically, the lag length was one for same lag length for all countries in each data set. Specifically, the lag length was one for the annual data set (ASEAN-9), Information Criterion) were used to select the most ap ally, the the lag length was one forVAR model, but these o select most appropriate After having estimated the structural shocks we calculate the correlation coefficients adata set (ASEAN-9), and four for the quarterly data set (ASEAN-6). and four for the quarterly data set (ASEAN-6). two criteria often suggested different lag lengths. Thu set (ASEAN-6). nt lag lengths. Thus, the author decided to set the of structural shocksthe forcorrelation each pair coefficients of countries. In addition, we test if the correlation g estimated the structural shocks we calculate same lag length for all countries ate the correlation coefficients After having thesignificantly structural shocks we calculate the correlation coefficients of structural shocks in foreach eachdata set. Specif each data set. Specifically, the lagestimated lengthare was one for coefficients positive by using the Fisher’s variance-stabilizing hocks for each paircorrelation of countries. In addition, we test if the correlation the annual data set (ASEAN-9), and four for the quarte on, we test if the d four for the quarterly data set In (ASEAN-6). 13. the pair of countries. addition, we if the correlation coefficients significantly by using Fisherʼs varianceThetest statistical background of theare test, in short,positive is as follows It is eFisher’s significantly positive transformation. by using the Fisher’s variance-stabilizing After having estimated the structural shocks we calc variance-stabilizing 13) tural shocks westabilizing calculate the correlation proved that coefficients the statistical statistic background z = (1/2)log[(1+ U ) /(1-U )] which is called the Fisher’s transformation. The 13 of the test, in short, is as follows . It is proved that the statistic .n The statistical background 13. It is of the test, in short, is as follows . It is of structural shocks for each pair of countries. In add short, is asInfollows of countries. addition, we test if the correlation variance-stabilizing transformation of the estimated correlation coefficient U , the statistic zthe = (1/2)log[(1+ U ) /(1-U )] which which is is called the Fisher’s called the Fisherʼs variance-stabilizing transformation of the estimated correlation ich coefficients are significantly positive by using the tive isby called using the Fisher’s Fisher’s variance-stabilizing izing transformation of U the estimatedfollows correlation coefficient U , with mean zero, and variance T-3 1/ 2 asymptotically a anormal correlation coefficient 13 of the test coefficient , ,asymptotically follows normaldistribution distribution with mean zero,transformation. and variance The statistical where background T is the kground of the test, in short, is as follows . It is 1/ 2 that statistic U ) /(1-U )] w size.is By the significance level at 5%, and running a one-tailed proved test (so that the the critical level of z = is (1/2)log[(1+ 1.645) /2)log[(1+ U )normal /(1-Usample )] distribution which called the Fisher’s 1/ 2 setting follows a with mean zero, and variance T-3 zero, and variance T-3 where T is the sample size. By setting the significance level at 5%, and running a variance-stabilizing transformation of the estimate n of the estimated correlation coefficient we can obtain the critical of Uthe , ,given the sample T.1.645) It is worth noting here that because the one-tailed testlevel (solevel that critical of size z ais we can obtain the critical level ofsample size T is e level sample By setting the significance at 5%, andlevel running at size. 5%, and running a 1/their 2 T. critical U ,country given the sampleso size It is worth here that because theare sample size T ais normal distribution with mea different from to country, levelsnoting of the correlation coefficients also follows different. asymptotically stribution mean zero, variance T-3obtain the critical level of (so thewith critical level of of zand is 1.645) we can canthat obtain the critical level different from country to country, so their critical levels of the correlation coefficients ample size T.sample It is worth T noting here that because the sample size T is because isat 5%, where T is the sample size. By setting the significan tting thethe significancesize level and running a 5.Results arecritical also different. country to country, so their levels of the correlation coefficients of the one-tailed test (so that the critical level of z is 1.645) w evel of correlation z is 1.645) coefficients we can obtain the critical level of nt. U , countries. given the sample size T. It is worth noting here th Tables 2 andthe 3 report thesize correlations of structural shocks between ASEAN orth noting here that because sample T is different from country to country, so their critical leve are also different. o their critical levels of the correlation coefficients 5. demand Results Correlations of shocks In Table 2, while the results using quarterly data do not show high correlations of demand shocks among the Tablesusing 2 and 3 report the that correlations structural shocks the between ASEAN countries, the results annual data imply Malaysia,ofSingapore, Thailand, Philippines and Indonesia (the countries. Results nd 3 reportbetween the correlations of structural shocks between ASEAN ASEAN-5) are good candidates for a CCA. The results also display minus or5. near-zero correlations for the other four ral shocks ASEAN countries except the case of Vietnam and the Philippines. rrelations of structural shocks between ASEAN [Table 2 about here] [Table 2 about here] Correlations of supply shocks Table 2 about here] Tables 2 and 3 report the correlations of struc countries. Similar to demand shocks, the results using quarterly data in Table 3a do not show high correlations among the 7 [Table 2 about here] 7 7 7 Examining the Possibility of Introducing a Common Currency for ASEAN(Vu Tuan Khai) (33) Table 2 33 Correlation coefficients of demand shocks of ASEAN 2a.ASEAN-6 (quarterly data 1980Q2 2004Q2) INA MAL SIN THA PHI VIE INA 1.00 MAL 0.14 1.00 SIN 0.11 0.08 1.00 THA -0.01 0.20 0.32* 1.00 0.08 0.23 1.00 0.13 0.21 0.37* 1.00 THA PHI VIE * PHI 0.19 0.19 VIE 0.32* 0.04 2b.ASEAN-9 (annual data 1966 2004) INA MAL SIN INA 1.00 MAL 0.66* 1.00 SIN 0.17 0.74* 1.00 THA 0.25 0.75* 0.82* PHI 0.02 0.49 * * 0.54 0.42* 1.00 VIE -0.27 -0.24 -0.07 -0.01 0.45* 1.00 LAO CAM MYA 1.00 LAO 0.19 -0.02 -0.40 0.05 -0.13 -0.16 CAM 0.10 -0.20 0.09 -0.23 -0.28 -0.29 1.00 0.00 1.00 MYA 0.27 -0.07 -0.42 -0.25 -0.25 0.05 -0.09 0.06 1.00 Notes: *means significantly positive at the 5% level. countries except the correlations between Indonesia, Thailand and the Philippines. However, if we turn to Table 3b we can see that the ASEAN-5 is suitable to form a CCA. This is consistent with the results in Table 2. The reasons for the ASEAN-5 countries to have high positive correlations in both demand and supply shocks might be that, in comparison with other four, their economic development stages are closer to one another, and their economies share many common features such as adopting export-oriented policies, receiving much FDI from Japan etc. In addition, there are close linkages between these economies, for example the close linkage in the electronic industry. There is an argument that we need to see also the correlation between one countryʼs supply shocks and another countryʼs demand shocks, because a supply shock occurs in one country (e.g. an improvement of technology in the electronic industry in Indonesia) may lead to a demand shock in another country (e.g. Malaysia, an electronic-partsexporting country, as output rises in Indonesiaʼs electronic industry causing import of electronic parts from Malaysia to increase). Doing that, however, does not make much sense because, as we saw above when explaining the AD-AS model and will discuss further right below, the responses (of CPI and GDP) to a demand shock are different from those to a supply shock in the short run and long run. For instance, in the short run CPI increases when a (positive) demand shock occurs while it decreases if that is a (positive) supply shock. Therefore, a high correlation between one countryʼs demand shocks and another countryʼs supply shocks does not mean low costs when the two countries form a CCA. 横浜国際社会科学研究 34 (34) Table 3 第 13 巻第 1・2 号(2008 年 8 月) Correlation coefficients of supply shocks of ASEAN 3a.ASEAN-6 (quarterly data 1980Q2 2004Q2) INA MAL SIN THA PHI VIE INA 1.00 MAL 0.46* 1.00 SIN 0.10 0.34* 1.00 THA 0.31* 0.13 -0.03 1.00 PHI 0.32* 0.03 0.00 0.17 1.00 VIE 0.24 0.00 -0.22 0.02 0.08 1.00 THA PHI VIE 3b.ASEAN-9 (annual data 1966 2004) INA MAL INA 1.00 MAL 0.75* 1.00 SIN 0.53* 0.60* * * THA 0.67 * 0.61 SIN LAO CAM MYA 1.00 0.49* 1.00 PHI 0.29 0.23 0.31* 0.32* 1.00 VIE 0.22 0.46* 0.25 0.13 -0.17 1.00 LAO 0.25 0.09 -0.21 -0.03 -0.07 0.22 1.00 CAM 0.14 0.27 0.37* 0.30 0.14 0.05 -0.50 1.00 MYA -0.24 -0.28 -0.26 -0.41 -0.09 0.29 0.51* -0.49 1.00 Notes: *means significantly positive at the 5% level. Responses of CPI and GDP to structural shocks We emphasize here one thing that has received little attention in the literature so far. That is, the signs of responses of an economic variable across countries to a shock need to be consistent. The sign is positive if the economic variable (GDP or CPI) increases, and negative if the economic variable decreases in response to a shock. This is a crucial point because, as we will see below, the responses of CPI and GDP to demand and supply shocks may not necessarily follow the implications of the AD-AS model, and more importantly their signs might be very different from country to country. To make this point clearer, consider a case where a (positive) supply shock causes CPI to fall in one country, and to rise in another. In this case not symmetric supply shocks, but asymmetric ones are desirable. A more complicated case is the one in which, in response to a (positive) demand shock, GDP increases in one country while decreases and then increases in another. In this case it is difficult to draw a relation between the symmetry of shocks and the costs of forming a monetary union. A merit of the VAR model is that it allows us to check the responses of economic variables to structural shocks. Figures A2a and A2b in the Appendix show the graphs of the impulse response functions. One country has four graphs, which display the cumulative responses of CPI and GDP to one standard deviation (s.d.) demand shock and one s.d. supply shock over time. For each country, the upper two graphs show the cumulative impacts of shocks on GDP, while the lower two show the cumulative impacts of shocks on CPI over time. The response of GDP to a demand shock Examining the Possibility of Introducing a Common Currency for ASEAN(Vu Tuan Khai) (35) Table 4 35 Number of cases consistent with the AD-AS model (for the estimated lines) consistent in part consistent inconsistent Response of GDP to a supply shock 15 0 0 Response of GDP to a demand shock 5 3 7 Response of CPI to a supply shock 7 2 6 Response of CPI to a demand shock 15 0 0 Table 5 Number of cases consistent with the AD-AS model (for the bands) consistent in part consistent inconsistent Response of GDP to a supply shock 14 1 0 Response of GDP to a demand shock 0 12 3 Response of CPI to a supply shock 5 10 0 Response of CPI to a demand shock 15 0 0 is displayed on the upper right-hand graph in which the line approaches the horizontal axis following the long run restriction imposed in the model. In each graph, the solid line is the point-estimates one. The other two broken lines, respectively called the upper band and lower band of the impulse response function, are generated by bootstrapping14) with a 95% confidence interval and one-thousand replications15). Tables 4 and 5 summarize the results in Figures 2a and 2b, showing the number of cases in which responses of CPI and GDP are consistent, in part consistent, and inconsistent with the implications of the AD-AS model discussed in section 2. These cases are judged by the sign of the impulse response function. Here, a case that is “in part consistent” is defined as the one which is consistent in the short run but inconsistent in the long run or vice versa. With two data sets for ASEAN-6 and ASEAN-9 we have a total of 15 cases for each response. It is clear from Table 4 that the responses of CPI to a demand shock, and the response of GDP to a supply shock follow the AD-AS model very well. However, the results for the responses of CPI to a supply shock, and of GDP to a demand shock are mixed. These facts are also observed in Table 5, with only one difference that for the response of CPI to a supply shock and the response of GDP to a demand shock, the number of “consistent” cases decreases while the number of “in part consistent” cases increases sharply. More importantly, we observe that the signs of responses of a variable to the same shock are not consistent between the countries. For instance, in response to a demand shock, GDP increases in the case of the Philippines, while decreases in the case of Malaysia (quarterly data). In response to a supply shock, CPI increases in the case of Singapore, but decreases and then increases in the case of Thailand. As a possibility, the mixed result of the response of CPI to a supply shock can be attributed to the aforementioned problem in correctly identifying structural shocks of the method. That is, there might have been demand shocks that had permanent effects on real GDP, and thus they were treated as supply shocks. As a result, these shocks, in contrast to supply shocks, raised the price level, making the behavior of the price level inconsistent with what is implied by the AD-AS model16). Anyhow, the results imply a problem on the validity of the Blanchard-Quah SVAR method in calculating the symmetry of shocks. The size of shocks, and the speed of adjustment to shocks As argued by Bayoumi and Eichengreen (1994), not only the correlation between the structural shocks, but also their size and speed of adjustment to shocks are important because even if shocks are asymmetric across the countries, 横浜国際社会科学研究 36 (36) Table 6 第 13 巻第 1・2 号(2008 年 8 月) The size of shocks and the speed of adjustment to shocks of ASEAN-9 Demand shocks Supply shocks Size Speed Size Speed INA 0.069 0.975 0.062 0.988 MAL 0.015 0.825 0.063 0.930 SIN 0.013 0.892 0.060 0.967 THA 0.026 0.815 0.088 0.938 PHI 0.034 0.981 0.061 0.992 VIE 0.182 0.605 0.045 0.615 LAO 0.251 0.973 0.032 0.997 CAM 0.088 0.953 0.077 0.984 MYA 0.095 0.967 0.093 0.931 ASEAN-9 average 0.086 0.891 0.064 0.929 EU average 0.010 0.533 0.027 0.898 but the size of shocks is small and they converge quickly to the equilibrium level, then the costs to adjust them are relatively minor. Another merit of the VAR model is that it provides us a way to calculate the size of underlying shocks and the speed of adjustment to these shocks. Here the size of shocks and the speed of adjustment are defined as follows17): the size of demand shocks = the first-year impact of one s.d. demand shock on CPI, the size of supply shocks = the impact in the long run of one s.d. supply shock on GDP, the speed of adjustment to demand shocks = the fourth-year impact / the impact in the long run of one s.d. demand shock on CPI, the speed of adjustment to supply shocks = the fourth-year impact / the impact in the long run of one s.d. supply shock on GDP18). The long run here is chosen to be 30 years. The smaller is the size of shocks and the faster (i.e. closer to unity) the speed of adjustment to shocks, the more suitable are the countries to form a CCA. The reason for choosing the responses of CPI to a demand shock, and of GDP to a supply shock in order to measure the size and speed of adjustment is that as we have seen above, these responses are consistent with the AD-AS model, and thus consistent across all ASEAN countries. In addition, for the purpose of comparison, estimation for EU was done using 13 EU countriesʼ annual data from IMF International Financial Statistics CD-ROM. The sample period of data on EU in this table was set to be 1980─2003, which is the same as that on ASEAN. Table 6 reports these results for ASEAN-9 using annual data. We can see that in comparison with the EU area, the sizes of shocks, especially the sizes of demand shocks in ASEAN are large. Two countries that have largest sizes of demand shocks are Vietnam and Laos, while their sizes of supply shocks are quite small. This result likely reflects the transition process to market economy in the late 1980s in these countries in which their government used to issue much money in order to finance budget deficits. As argued by Zhang et al. (2004) the 1997─1998 Asian financial crisis played a role to expand structural shocks. By drawing graphs of the structural shocks calculated, it is found that rather than demand shocks, supply shocks were negative and large for all ASEAN-5 countries and Vietnam in the period 1997 ─1998. This might be consistent with the argument that the Asian crisis was a supply shock. When we confine to the Examining the Possibility of Introducing a Common Currency for ASEAN(Vu Tuan Khai) (37) 37 group of ASEAN-5, the average size of demand shocks is 0.031, relatively closer to that of the EU. When we turn to the results of speed of adjustment, it is clear that structural shocks, especially demand shocks converge to the equilibrium faster in ASEAN than in the EU. Thus it can be argued that ASEAN has a more favorable environment to adopt a common currency than the EU in terms of speed of adjustment to shocks. 6. Concluding remarks In summary, we find that correlations of both demand and supply shocks are high between a group of Indonesia, Malaysia, Singapore, Thailand and the Philippines (the ASEAN-5), but not all ASEAN countries. In comparison with the EU area, while the sizes of shocks are larger, the speed of adjustment to shocks is faster. The results suggest that ASEAN as a whole does not form an optimum currency area, but the ASEAN-5 countries are good candidates to introduce a common currency. Regarding the signs of responses of the variables to shocks, we find that the responses of CPI and GDP to structural shocks are consistent with the AD-AS model and consistent among all ASEAN countries. However, the responses of CPI to a supply shock, and of GDP to a demand shock are mixed, and quite different between the countries. This implies an important problem about the validity of the Blanchard-Quah VAR method. For the other four ASEAN countries, although the results do not support their introduction of a common currency with the ASEAN-5 countries, given the fact of active economic integration and the strong will of governments in the region to cooperate, it can be argued that the results do not necessarily reject the possibility for them for the following reasons. First, the data used in this analysis for these four countries are those of the 1980s and 1990s, the period when countries like Vietnam and Laos were in a transition process, and Cambodia was suffering from the aftermath of its civil war with much instability. These countries may need time for economic development before considering the introduction of a common currency. A period to prepare, i.e. a period for their economies to regain stability, and moreover, for economic variables among countries in the region to converge to some degree as had occurred in the EU, is likely needed. Second, we still need to analyze the beneficial aspect of forming a CCA, especially under the present dynamism in the region where trade and investments are very active. Furthermore, as argued by Frankel and Rose (1998), shocks are likely to become symmetric as trade increases. I leave these issues for future work. Acknowledgements This is a revised version of my master thesis submitted to the International Graduate School of Social Sciences, Yokohama National University in March, 2005. I am deeply indebted to Etsuro Shioji, my Academic Advisor, for his valuable advice and unstinting guidance. I am grateful to Kiyotaka Sato for his kind encouragement and comments. I am benefited from comments of Keiichi Koda, Craig Parsons, and Tsunao Okumura. I would also like to thank an anonymous referee for very helpful and detailed comments and suggestions. The remaining errors are my own. References ASEAN Secretariat, Media Release─Vientiane, 29th November 2004. Available from http://www.aseansec.org/home.htm. Bayoumi, T. and Eichengreen, B. (1993), “Shocking Aspects of European Monetary Integration". In Adjustment and Growth in the European Monetary Union (eds) Torres, F. and Giavazzi, F., Cambridge University Press, Cambridge, pp. 193─229. Bayoumi, T. and Eichengreen, B. (1994), “One Money or Many? Analyzing the Prospects for Monetary Unification in Various Parts of the World", Princeton Studies in International Finance, 16, International Section, Princeton University. Blanchard, O.J. and Quah, D. (1989), “The Dynamic Effects of Aggregate Demand and Supply Disturbances", American 38 (38) 横浜国際社会科学研究 第 13 巻第 1・2 号(2008 年 8 月) Economic Review, 79 (September), 665─673. De Grauwe, P. (2000), The Economics of Monetary Integration (4th ed.), Oxford University Press, Oxford. Dornbush, R., Fischer, S. and Startz, R. (2001), Macroeconomics, International Edition (8th ed.), the McGraw-Hill Companies, Inc., Ch. 2, 5, 6. Frankel, J. A. and Rose, A. (1998), “The Endogeneity of the Optimum Currency Area Criterion", Economic Journal, 108 (July), 1009─1025. Mundell, R. (1961), “A Theory of Optimum Currency Areas", American Economic Review, 51 (September), 657─665. Zhang, Z., Sato, K., and McAleer, M. (2003), “Is a Monetary Union Feasible for East Asia?", Applied Economics, 36, 1031─ 1043. References on data Asian Development Bank, Key Indicators 2004. Asia Regional Information Center (ARIC) homepage. Available from http://aric.adb.org/. International Centre for the Study of East Asian Development (ICSEAD) homepage. Available from http://www.icsead.or.jp/. International Monetary Fund, International Financial Statistics 2004. United Nations, Statistical Yearbook 2004. Appendix Table A1 Average growth rate (1999─2003) Recent socio-economic indicators of ASEAN Trade in percent of GDP (97─01) Real GDP in billions USD (2003) Population (2003) Brunei 2.9 % 101.4% 4.7 na Cambodia 6.8 % 78.6% 4.2 13.3 Indonesia 3.4% 59.8% 208.5 215.0 Laos 6.1% 53.6% 2.0 5.7 Malaysia 4.9% 172.9% 103.2 25.0 Myanmar 9.0% 50.5% 9.6 53.2 Philippines 4.3% 79.9% 80.4 81.1 Singapore 3.6% 274.6% 91.4 4.2 Thailand 4.7% 89.6% 143.3 64.0 Vietnam 6.5% 82.4% 39.0 80.9 ASEAN 5.2% 118.8% 686.3 542.4 VLCM1 7.1% 66.3%3) 8.0%* 28.2%* ASEAN-52 4.2% 135.4% 91.3%* 71.8%* Note: *as percent of total ASEAN 1 VLCM: Vietnam, Laos, Cambodia, Myanmar. 2 ASEAN-5: Indonesia, Malaysia, Singapore, Thailand and the Philippines. 3 For comparison, the same data for the US, Japan and Korea are 24.2%, 19.0% and 70.9%, respectively. Sources: IFS 2004 and ADB Key Indicators 2004. Examining the Possibility of Introducing a Common Currency for ASEAN(Vu Tuan Khai) (39) Figure A2 39 Accumulated responses of CPI and GDP to structural shocks and bootstrap 95% confidence bands A2a.ASEAN-6 (quarterly data 1980Q2 2004Q2) MALAYSIA INDONESIA GDP to supply shock .06 .05 GDP to demand shock .010 GDP to supply shock .000 .04 .05 .005 -.004 .03 .04 -.008 .000 .02 .03 -.012 -.005 .02 .01 -.010 .01 .00 5 10 15 CPI to supply shock .00 .00 -.015 20 5 10 15 -.016 2 4 6 20 8 10 12 14 16 18 20 22 24 CPI to supply shock .012 CPI to demand shock .05 6 8 10 12 14 16 18 20 22 24 20 22 24 20 22 24 20 22 24 20 22 24 20 22 24 CPI to demand shock .008 .004 .03 .006 .004 .02 -.08 .000 .002 .01 -.10 -.12 5 10 15 -.004 .00 20 5 10 15 2 4 6 8 10 12 14 16 18 GDP to supply shock .024 .016 .012 .008 .004 2 4 6 8 10 12 14 16 18 20 22 24 CPI to supply shock .000 .07 .005 .06 .004 .05 .003 .04 .002 .03 .001 .02 .000 .01 -.001 .00 4 6 8 10 12 14 16 18 20 22 24 CPI to demand shock .020 .012 -.016 .008 .004 2 4 6 8 10 12 14 16 18 20 22 24 2 4 .05 6 8 10 12 14 16 18 20 22 24 2 4 6 8 10 12 14 16 18 20 22 24 CPI to supply shock .005 .004 8 10 12 14 16 18 20 22 24 CPI to supply shock .015 -.015 10 12 14 16 18 .001 2 4 6 8 10 12 14 16 18 20 22 24 GDP to supply shock .000 2 4 6 8 10 12 14 16 18 .010 .005 .000 -.005 -.010 -.015 .000 4 6 8 10 12 14 16 18 20 22 24 CPI to demand shock .016 -.005 GDP to demand shock .015 .010 2 8 .002 .005 6 6 CPI to demand shock .003 .015 -.010 4 4 .006 .004 -.002 2 .007 .020 -.005 2 -.04 .006 .025 .000 .01 18 GDP to demand shock .009 .030 .005 .02 16 .008 .035 .010 .03 14 VIETNAM GDP to demand shock .015 .04 12 -.03 THAILAND GDP to supply shock 10 -.02 .000 -.028 .000 8 .00 .002 -.024 6 -.01 .008 -.020 4 .02 .010 .016 -.012 2 .01 .012 -.004 -.008 GDP to supply shock .08 .006 2 .000 SINGAPORE GDP to demand shock .007 .020 20 22 24 20 PHILIPPINES 2 4 6 8 10 12 14 16 18 20 22 24 CPI to supply shock .08 -.020 2 4 6 8 10 12 14 16 18 CPI to demand shock .20 .014 .010 .012 .005 .010 .000 .04 .16 .00 .12 -.04 .08 .008 .006 -.005 .004 -.010 -.015 4 .010 -.06 .00 2 .012 .04 -.04 -.032 -.020 .008 -.02 .000 GDP to demand shock .004 -.08 .04 .002 2 4 6 8 10 12 14 16 18 20 22 24 .000 2 4 6 8 10 12 14 16 18 20 22 A2b. ASEAN-9 (annual data 1966-2004) 24 -.12 2 4 6 8 10 12 14 16 18 20 22 24 .00 2 4 6 8 10 12 14 16 18 横浜国際社会科学研究 40 (40) 第 13 巻第 1・2 号(2008 年 8 月) A2b.ASEAN-9 (annual data 1966 2004) CAMBODIA GDP to supply shock .16 INDONESIA GDP to demand shock .005 .14 .09 .08 .06 .05 -.010 -.015 .04 -.015 .02 -.025 .00 -.030 5 10 15 20 CPI to supply shock .6 .03 5 10 15 20 CPI to demand shock .2 .1 5 10 15 20 .0 15 20 10 15 20 .05 .05 .04 .03 .02 .01 5 10 15 20 .00 10 15 20 CPI to supply shock .2 .4 .0 .3 -.1 .2 -.2 .1 -.3 .0 20 -.008 .03 -.012 .02 -.016 .01 5 10 15 20 CPI to demand shock .00 GDP to demand shock -.004 .04 .5 .1 15 .000 .05 .000 5 10 .004 .06 -.004 -.008 5 .008 .07 .004 .01 .00 .012 .08 .008 .02 GDP to supply shock .09 .012 .03 20 MALAYSIA GDP to demand shock .016 .04 15 .06 -.06 LAOS GDP to supply shock 10 CPI to demand shock .07 -.04 -.12 5 .08 -.10 5 -.030 .09 -.08 .0 -.2 10 CPI to supply shock .00 .3 -.1 5 -.02 .4 .1 .00 .02 .5 .2 -.025 .01 .4 .3 -.020 .02 .6 .5 -.005 .06 -.010 -.020 .04 .000 .07 -.005 .10 GDP to demand shock .005 .08 .000 .12 GDP to supply shock 5 10 15 20 CPI to supply shock .05 -.020 5 .05 .04 10 15 20 CPI to demand shock .04 .03 .03 .02 5 10 15 20 .02 .01 .01 .00 5 10 15 20 -.01 5 10 15 20 MYANMAR GDP to supply shock .12 .08 .00 .004 .002 .02 .000 .01 10 15 20 CPI to supply shock .20 -.04 5 10 15 20 CPI to demand shock .30 .00 .25 -.02 .10 .20 -.04 .05 .15 -.06 .00 .10 -.08 -.05 .05 -.10 5 10 15 20 .00 5 10 15 5 20 -.12 10 15 20 CPI to supply shock .00 .15 -.10 .006 .03 -.03 5 20 .008 .05 -.02 .02 15 .010 .04 .04 10 GDP to demand shock .012 .06 -.01 .06 .00 GDP to supply shock .07 .08 5 PHILIPPINES GDP to demand shock .01 .10 .00 -.002 5 10 15 20 CPI to demand shock .07 .06 .05 .04 .03 .02 .01 5 10 15 20 .00 5 10 15 20 Examining the Possibility of Introducing a Common Currency for ASEAN(Vu Tuan Khai) (41) SINGAPORE GDP to supply shock .08 THAILAND GDP to demand shock .012 .07 GDP to supply shock .12 .008 .10 .004 .04 .08 .000 .06 .03 -.004 .04 -.008 .02 .020 .015 .010 .005 .000 .02 .01 .00 5 10 15 20 CPI to supply shock .06 -.012 5 10 15 20 CPI to demand shock .035 .005 -.02 .00 .000 -.04 10 15 20 20 -.010 5 10 15 20 CPI to demand shock .10 .08 .06 .04 .00 .010 .01 5 15 .02 .015 .02 10 CPI to supply shock .04 .020 .03 5 .06 .025 .04 -.005 .08 .030 .05 .00 GDP to demand shock .025 .06 .05 41 5 10 15 20 .02 5 10 15 20 .00 5 10 15 20 VIETNAM GDP to supply shock .06 GDP to demand shock .012 .010 .05 .008 .04 .006 .03 .004 .002 .02 .000 .01 .00 -.002 5 10 15 20 CPI to supply shock 0.4 5 10 15 20 CPI to demand shock .9 .8 0.0 .7 -0.4 .6 .5 -0.8 .4 -1.2 .3 .2 -1.6 -2.0 -.004 .1 5 10 15 20 .0 5 10 15 20 Notes 1) ASEAN now consists of 10 members: Indonesia, Malaysia, Singapore, Thailand, Philippines, Brunei, Vietnam, Laos, Cambodia, and Myanmar. 2) See the Media Release─Vientiane, 29 November 2004. 3) First discussed in Mundell (1961). 4) Even in this case the costs could be small if there exists some kind of adjustment mechanisms in the market, for example the adjustment through the labor market provided that wages are flexible or labor is mobile across countries. These conditions, however, are often hardly coefficients satisfied in reality.of demand shocks of ASEAN Table 2: Correlation 5) A more comprehensive explanation about the theory of optimum currency area is given De Grauwe (2000). Bayoumi and 2a. Eichengreen ASEAN-6 (quarterly data 1980Q2-2004Q2) (1994) discussed in detail the concept of symmetry of shocks as a criterion for introducing a CCA. INASingapore, MAL THA(often PHI VIE 6) Indonesia, Malaysia, ThailandSIN and Philippines known as ASEAN-5). 7) The reasons might INA 1.00be that these countries joined ASEAN late, and the data were not available. 8) See also Bayoumi and Eichengreen (1993). MAL 0.14 1.00 9) See Dornbusch et al. (2001) pp. 118─122. SIN 0.11 0.08 1.00 me to think about this important point. 10) I thank an anonymous referee for suggesting THA 0.20 1.00 11) Brunei is not-0.01 included in the analysis0.32* due to the lack of data. Tables PHI VIE 0.19 0.32* 0.19* 0.04 0.08 0.13 0.23 0.21 1.00 0.37* 1.00 42 (42) 横浜国際社会科学研究 第 13 巻第 1・2 号(2008 年 8 月) 12) For the quarterly data of some countries (for instance, those of Malaysia, Vietnam, and recent data of ASEAN-6), the author contacted with the organizations and departments in charge, and received the data by e-mail. 13) See Zhang et al. (2004). 14) See Enders (2004) pp. 234─238 for more details of this method. 15) For several cases bootstrapping with ten-thousand replications was tried and the results were almost the same as onethousand-time repetition. 16) The explanation for the mixed result of response of GDP to a demand shock is still unknown here. 17) Drawn upon Zhang et al. (2004). 18) For some cases where the four-year impact went beyond the long run level, the speed of adjustmentʼs definition is corrected as follows: 2-(the fourth-year impact / the impact in the long run). [ブー トウン カイ 横浜国立大学大学院国際社会科学研究科博士課程修了]