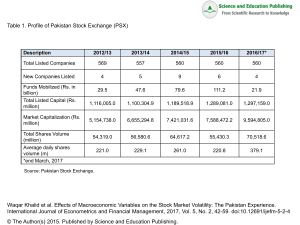

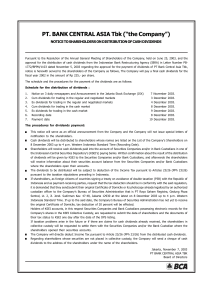

Chapter 12 Corporations: Organization, Capital Stock Transactions, and Dividends Accounting, 21st Edition Warren Reeve Fess PowerPoint Presentation by Douglas Cloud Professor Emeritus of Accounting Pepperdine University © Copyright 2004 South-Western, a division of Thomson Learning. All rights reserved. Task Force Image Gallery clip art included in this electronic presentation is used with the permission of NVTech Inc. Some of the action has been automated, so click the mouse when you see this lightning bolt in the lower right-hand corner of the screen. You can point and click anywhere on the screen. Objectives 1. Describe the nature of the corporate After studying this form of organization. chapter, you should 2. List the two main sources of be able to: stockholders’ equity. 3. List the major sources of paid-in capital, including the various classes of stock. 4. Journalize the entries for issuing stock. 5. Journalize the entries for treasury stock transactions. Objectives 6. State the effect of stock splits on corporate financial statements. 7. Journalize the entries for cash dividends and stock dividends. 8. Describe and illustrate the reporting of stockholders’ equity. 9. Compute and interpret the dividend yield on common stock. Organizational Structure of a Corporation Stockholders (owners of corporation stock) Board of Directors (elected by stockholders) Officers (selected by board of directors) Employees Forming a Corporation First step is to file an application of incorporation with the state. Because state laws differ, corporations often organize in states with more favorable laws. More than half of the largest companies are incorporated in Delaware. State grants a charter or articles of incorporation which formally create the corporation. Management and board of directors prepare bylaws which are operation rules and procedures. Forming a Corporation On January 5, the firm paid the organization costs of $8,500. This amount includes legal fees, taxes and licenses, promotion costs, etc. Jan. 5 Organization Costs Cash Paid cost of organizing the corporation. 8 500 00 8 500 00 Stockholders’ Equity Liabilities Assets Stockholders’ Stockholders’ Equity Equity Stockholders’ Equity = Assets – Liabilities Represents the stockholders’ share of the total assets. Stockholders’ Equity Liabilities There Assets are two sources Stockholders’ of stockholders’Stockholders’ Equity Equity equity. Stockholders’ Equity Liabilities Assets Stockholders’ Stockholders’ Equity Equity 1 Stockholders’ Equity: Paid-in capital: Common stock $xxxxx Retained earnings xxxx Total $xxxxx Stockholder investments Stockholders’ Equity Liabilities Assets Stockholders’ Stockholders’ Equity Equity Stockholders’ Equity: Paid-in capital: Common stock $xxxxx Retained earnings xxxx Total $xxxxx 2 Reinvested earnings Sources of Paid-In Capital Authorized Issued Outstanding Number of Shares Sources of Paid-In Capital Major Rights that Accompany Ownership of a Share of Stock 1. The right to vote in matters concerning the corporation. 2. The right to share in distribution of earnings. 3. The right to share in assets on liquidation. Classes of Stockholders The two primary classes of paid-in capital are common stock and preferred stock. The primary attractiveness of preferred stocks is that they are preferred over common as to dividends. Money available for dividends Preferred Stockholders Common Stockholders Classes of Stockholders Common Stock—the basic ownership of stock with rights to vote in election of directors, share in distribution of earnings, and purchase additional shares. Preferred Stock—A class of stock with preferential rights over common stock in payment of dividends and company liquidation. Nonparticipating Preferred Stock A nonparticipating preferred stock is limited to a certain amount. Assume 1,000 shares of $4 nonparticipating preferred stock and 4,000 shares of common stock and the following: 2005 Net income Amount retained Amount distributed 2006 2007 $20,000 $55,000 $62,000 10,000 20,000 40,000 $10,000 $35,000 $22,000 Nonparticipating Preferred Stock Amount distributed $10,000 $35,000 $22,000 Preferred dividend (1,000 shares) 4,000 4,000 4,000 Common dividend (4,000 shares) $6,000 $31,000 $18,000 Dividends per share: Preferred $ 4.00 $ 4.00 $ 4.00 Common $ 1.50 $ 7.75 $ 4.50 Cumulative Preferred Stock So, preferred dividends are two years in arrears. Assume 1,000 shares of $4 cumulative preferred stock and 4,000 shares of common stock. No dividends were paid in 2005 and 2006. Cumulative Preferred Stock On March 7, 2007, the board of directors declares dividends of $22,000. Cumulative Preferred Stock Preferred Stock Dividends Dividends Paid in 2007 Total dividends paid, $22,000 $4,000 2005 (In arrears) $4,000 $4,000 2006 (In arrears) $4,000 $4,000 $4,000 2007 Preferred Stock (Current dividend) $10,000 Common Stock Other Sources of Paid-in Capital On April 20 the city of Moraine donated land to Merrick Corporation as an incentive to relocate its headquarters to Moraine. The land was valued at $500,000. Apr. 20 Land 500 000 00 Donated Capital Recorded land donated by the city of Moraine. 500 000 00 Issuing Stock A corporation is authorized to issue 10,000 shares of preferred stock, $100 par, and 100,000 shares of common stock, $20 par. Issuing Stock On April 1, one-half of each class of authorized stock is issued at par for cash. Apr. 1 Cash 1,500000 00 Preferred Stock 500 000 00 Common Stock 1,000000 00 Issued preferred stock and common stock at par. Issuing Stock Common Stock and Preferred Stock accounts are controlling accounts. A record of each stockholders’ name, address, and number of shares is kept in a stockholders’ subsidiary ledger. Issuing Stock at a Premium On March 15, Caldwell Company issues 2,000 shares of $50 par preferred stock for cash at $55. Mar. 15 Cash 110 000 00 Preferred Stock 100 000 00 Paid-in Capital in Excess of Par-Preferred Stock Issued 2,000 shares of $50 par preferred stock at $55. 10 000 00 Issuing Stock at a Premium When stock is issued for more than its par, the stock has sold at a premium. It has sold at a discount if issued for less than its par. The $10,000 excess is recorded in a separate account because some states do not consider this to be part of legal capital and may be used for dividends. Issuing Stock at a Premium On Nov. 12, a corporation acquired land for which the fair market value cannot be determined. The corporation issued 10,000 shares of $10 par common that has a current market value of $12 in exchange for the land. Nov. 12 Land 120 000 00 Common Stock Paid-in Capital in Excess of Par Issued $10 par common stock valued at $12 per share, for land. 100 000 00 20 000 00 Issuing Stock at a Premium Stock issued for assets other than cash should be recorded at the fair market value of the asset or fair market value of the stock, whichever can be more clearly determined. Issuing Stock at No-Par On February 23, a corporation issues 10,000 shares of no-par common stock at $40 a share. Feb. 23 Cash 400 000 00 Common Stock Issued 10,000 shares of no-par common stock at $40. 400 000 00 Issuing Stock at No-Par Later, on March 9, the corporation issues 1,000 additional shares at $36. Mar. 9 Cash 36 000 00 Common Stock Issued 1,000 shares of no-par common stock at $36. 36 000 00 Issuing Stock at No-Par Some states require that the entire proceeds from the sale of no-par stock be treated as legal capital. Issuing Stock at No-Par Also, no-par stock may be assigned a stated value per share. The stated value is recorded similar to a par value. Issuing Stock with a Stated Value On March 30, issued 1,000 shares of no-par common stock at $40; stated value, $25. Mar. 30 Cash 40 000 00 Common Stock 25 000 00 Paid-in Capital in Excess of Stated Value Issued 1,000 shares of no-par common stock at $36; stated value, $25. 15 000 00 Treasury Stock Transactions Occasionally, a corporation buys back its own stock for the purpose of later reissuing it. This stock is referred to as treasury stock. Treasury Stock Transactions Treasury stock is stock that: 1. has been issued as fully paid. 2. has been reacquired by the corporation. 3. has not been canceled or reissued. A commonly used method of accounting for treasury stock is the cost method. Treasury Stock Transactions Cost Method On January 5, a firm purchased 1,000 shares of treasury stock (common stock, $25 par) at $45 per share. Jan. 5 Treasury Stock Cash Purchased 1,000 shares of treasury stock at $45. 45 000 00 45 000 00 Treasury Stock Transactions Cost Method On June 2, sold 200 shares of treasury stock at $60 per share. June 2 Cash 12 000 00 Treasury Stock 9 000 00 Paid-in Capital from sale of Treasury Stock Sold 200 shares of treasury stock at $60. 3 000 00 Treasury Stock Transactions Cost Method On September 3, sold 200 shares of treasury stock at $40 per share. Sep. 3 Cash 8 000 00 Paid-in Capital from Sale of Treasury Stock Treasury Stock Sold 200 shares of treasury stock at $60. 1 000 00 9 000 00 Stock Splits A corporation sometimes reduces the par or stated value of their common stock and issues a proportionate number of additional shares. This is called a stock split. Stock Splits BEFORE STOCK SPLIT AFTER 5-1 STOCK SPLIT 4 shares, $100 par 20 shares, $20 par $400 total par value $400 total par value Stock Splits A stock split does not change the balance of any corporation accounts. However, it can make the stock more attractive to investors by reducing the price of a share, Accounting for Cash Dividends Dividends are distributions of retained earnings to stockholders. Dividends may be paid in cash, stock, or property. Dividends, even on cumulative preferred stock, are never required, but once declared become a legal liability of the corporation. Accounting for Cash Dividends Corporations generally declare and pay cash dividends on shares outstanding when three conditions exist: 1. Sufficient retained earnings 2. Sufficient cash 3. Formal action by the board of directors Retained Earnings 50,000 Accounting for Cash Dividends There are three important dates relating the dividends. Accounting for Cash Dividends First is the date of declaration. Assume that on December 1, Hiber Corporation declares a $42,500 dividend. Accounting for Cash Dividends Date of Declaration Dec. 1 Cash Dividends Cash Dividend Payable Declared cash dividend. 42 500 00 42 500 00 Accounting for Cash Dividends The second important date is the date of record. For Hiber Corporation this would be December 11. Accounting for Cash Dividends On this date, ownership of shares determines who receives the dividend. No entry is required. Accounting for Cash Dividends The third important date is the date of payment. On January 2, Hiber issues dividend checks. Accounting for Cash Dividends Date of Payment Jan. 2 Cash Dividends Payable Cash Paid cash dividends. 42 500 00 42 500 00 Accounting for Stock Dividends A distribution of dividends to stockholders in the form of the firm’s own shares is called a stock dividend. Accounting for Stock Dividends Stock dividends transfer pro rata shares of stock to stockholders. Assume Hendrix Corporation issues a 5% stock dividend on common stock, $20 par, 2,000,000 shares issued. Accounting for Stock Dividends Hendrix Corporation, December 15 (before dividend) Common Stock, $20 par $40,000,000 Paid-in Capital in Excess of Par--Common Stock 9,000,000 Retained Earnings 26,600,000 Dec. 15 Stock Dividends Stock Dividends Distributable 3,100 000 00 2,000000 00 Paid-in Capital in Excess of Par—Common Stock Declared stock dividend. 1,100000 00 Accounting for Stock Dividends On January 10, Hendix Corporation issues the stock. This action increases the number of shares outstanding by 100,000. Jan. 10 Stock Dividends Distributable Common Stock Issued stocks for the stock dividend. 2,000 000 00 2,000000 00 Accounting for Stock Dividends Hendrix Corporation, December 15 (before dividend) Common Stock, $20 par $40,000,000 Paid-in Capital in Excess of Par--Common Stock 9,000,000 Retained Earnings 26,600,000 $75,600,000 Hendrix Corporation, January 10 (after dividend) Common Stock, $20 par Paid-in Capital in Excess of Par--Common Stock Retained Earnings $42,000,000 10,100,000 23,500,000 $75,600,000 Financial Analysis and Interpretation Use: To Yield indicate the rate of return to common Dividend stockholders in terms of dividends Dividends per share of common Market price per share of common 2004 $ 0.80 $20.50 2003 $ 0.60 $13.50 Dividends per Share of Common Stock Dividend Yield Market Price per Share of Common Stock $.60 Dividend Yield, 2006 $13.50 = 4.4% $.80 Dividend Yield, 2007 = 3.9% $20.50 There are two ways to report stockholders’ equity in the balance sheet. In Slide 58, each class of stock is listed first, followed by its related paid-in capital accounts. 61 Stockholders’ Equity Paid-in capital: Preferred 10% stock, $50 par, cumulative (2,000 shares authorized and issued) Excess of issue price over par Common stock, $20 par (50,000 shares authorized, 45,000 issued) Excess of issue price over par From sale of treasury stock Total paid-in capital Retained earnings Total Deduct treasury stock (600 shares at cost) Total stockholders’ equity $100,000 10,000 $900,000 190,000 $ 110,000 1,090,000 2,000 $1,202,000 350,000 $1,552,000 27,000 $1,525,000 Slide 60 shows the second method. Note that the stock accounts are listed first. The other paid-in capital accounts are listed as a single item described as Additional paidin capital. Stockholders’ Equity Contributed capital: Preferred 10% stock, cumulative $50 par (2,000 shares authorized and issued) Common stock, $20 par (50,000 shares authorized, 45,000 issued) Additional paid-in capital Total contributed capital Retained earnings Total Deduct treasury stock (600 shares at cost) Total stockholders’ equity $100,000 900,000 202,000 $1,202,000 350,000 $1,552,000 27,000 $1,525,000 Chapter 12 The End