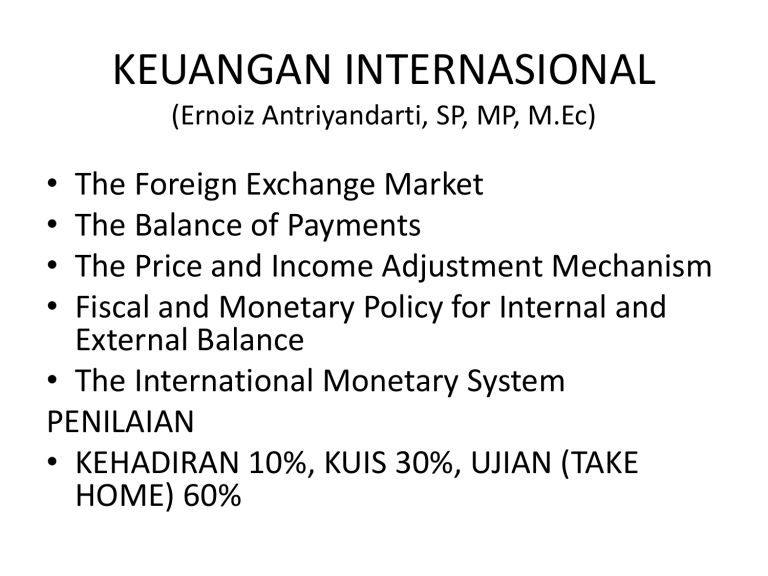

i. manajemen keuangan internasional

advertisement

KEUANGAN INTERNASIONAL (Ernoiz Antriyandarti, SP, MP, M.Ec) • • • • The Foreign Exchange Market The Balance of Payments The Price and Income Adjustment Mechanism Fiscal and Monetary Policy for Internal and External Balance • The International Monetary System PENILAIAN • KEHADIRAN 10%, KUIS 30%, UJIAN (TAKE HOME) 60% Dasar adanya pasar pertukaran mata uang • Transfer daya beli dari mata uang suatu negara ke negara lain • Penyediaan kredit untuk perdagangan luar negeri • Menghindari resiko pertukaran mata uang Kegiatan ekspor-impor sangat bergantung pada konversi nilai mata uang dari negara pengimpor terhadap negara pengekspor Organisasi Pasar Pertukaran Mata Uang 1. 2. 3. 4. Eksportir, importir, turis, imigran, investor Bank Komersial Broker Bank Sentral Sistem Nilai Tukar 1. 2. 3. • Foreign Exchange Rate The Flexible Exchange-Rate System The Fixed Exchange-Rate System Tiga demensi yang membedakan keuangan internasional dengan keuangan domestik: 1. Risiko valas dan politik, 2. Ketidaksempur-naan pasar, 3. Sekumpulan peluang yang semakin luas. • • • • • KEKUATAN PENGUBAH LING-KUNGAN PERSAINGAN GLOBAL Deregulasi besar2-an. Matinya komunisme. Privatisasi atas perusahaan milik pemerintah di dunia yang menyusutkan sektor publik. Revolusi dalam teknologi informasi. Peningkatan dalam pasar terhadap kontrol perusahaan dengan gelombang pengambilalihan, merger. KEKUATAN PENGUBAH LING-KUNGAN PERSAINGAN GLOBAL • Pembuangan atas kebijakan2 yang statis dan menggantikannya dengan kebijakan pasar bebas di negara2 ketiga. • Ketertundukan negara2 di dunia terhadap kekakuan dan standar pasar global yang ada. GLOBALISASI EKONOMI DUNIA: TREN TERAKHIR • 1. Munculnya pasar2 keuangan yang terglobalisasi: integrasi yang cepat atas pasar2 modal dan keuangan. • Globalisasi pasar keuangan ini awalnya datang dari pemerintah2 negara utama yang mulai menderegulasi pasar2 valas dan modalnya. GLOBALISASI EKONOMI DUNIA: TREN TERAKHIR • 2. Munculnya Euro sebagai mata uang global: dimulai pada 1999, dengan jumlah anggota 12 negara berpenduduk 300 juta. • 3. Liberalisasi perdagangan & integrasi ekonomi: Fenomena munculnya GATT, WTO, EU, NAFTA, dan AFTA. • 4. Privatisasi: suatu negara menjual kepemilikan & operasinya atas suatu bisnis dengan mengalihkannya kepada sistem pasar bebas. How a Foreign Exchange Transaction is Conducted Spot Market for Foreign Exchange • Spot Market value date = 2 days (to clear) – WSJ gives Ask/Offer Rate ~ selling price – Any published rate is for a specific time – may change 15,000 times a day or more. • Spreads – BID (buying) rate and ASK rate • e.g., monitor might show “CAD 1.5223-28 (per US$).” BID = 1.5223, ASK = 1.5228. Spread is 5 “pips,” where pip is last decimal. – Spread is a transaction cost – Spread is larger for more thinly traded (lower liquidity) currencies • Rate Determination ~ supply of and demand for currencies. – Central Bank intervention influences supply and/or demand Arbitrage: Buy Low, Sell High • Exchange Rates will be equalized across markets/actors • Example: let $/DM = .5 in NY, and = .55 in Frankfurt – profitable to buy DM in NY, sell DM in Frankfurt • $1000 DM2000 in NY $1100 in Frank. profit $100 – Demand for DM in NY, ENY – Supply DM in Frankfurt, EFrank. : Exchange rates converge! – Highest ASK no lower than lowest BID ~ Difference in Exchange Rates no larger than transaction cost! • Triangular Arbitrage – Cross-rates must correspond to pairs of direct rates • $/DM in NY = .5; DM/£ in Frank. = 3; then £/$ in London must be 0.667 Foreign Exchange Risk • Spot Rates may change in a way that makes a transaction less (or more) profitable. – You are “uncovered” if you depend on spot market • e.g., ¥10m account payable due in 90d. If you wait 90d to buy yen and $ depreciates, the ¥10m costs you more. • Types of Risk Exposure – Translation Exposure – Economic Exposure – Transaction Exposure • domestic currency value of future transactions. • Managing XR Risk: Forward, Futures, and Option Markets Forward Markets • Buying & Selling currency for future delivery ~ 30, 90, or 180 days • Contract stipulates amount traded, the price, and value date – price = forward rate = F ($/unit foreign currency) – F may be quoted outright (actual quote), or by forward spread (from spot rate; used by dealing systems). • Forward Premiums and Discounts – F < E ~ fewer $ to buy FX in future than now; $ trading at forward premium – F > E ~ forward discount – signs reversed if use indirect quote • e.g., CAD 1.5228 (per US$) spot, 1.5244 180d fwd CAD at forward discount, $ at forward premium Forward Markets, cont. • Forward rates reflect relative rates of return and expectations of future exchange rates. • Actors using forward contracts are covered or hedged. • Problems with Forwards – Default Risk – Illiquidity ~ contracts customized, limited transferability – Solutions: short maturity; margins; limited clientele. • Swaps – Combine two transactions into one – Foreign Exchange Swap: spot trade with opposing forward trade – Currency Swap: firms borrow domestic currency, swap principal w/ foreign firm ~ cheaper foreign currency borrowing. Futures Like Forward, except • active secondary market • standardized contracts ~ fewer currencies, standardized value and expiry date • smaller than forwards ~ more accessible to smaller businesses • a clearing house guarantees contract against default, requires margin against unprofitable positions. – day-to-day losses & gains posted against margin deposit; defaulting only saves last day’s losses, not cumulative losses. – if margin account falls too low, have to top it off Options • Underlying Asset = future or spot cash • Right, but not obligation, to buy or sell at strike price – – – – CALL ~ right to buy PUT ~ right to sell Premium ~ up-front cost of obtaining right American vs. European options • Protects against unfavorable spot XR changes, while not limiting ability to exploit favorable spot XR changes – “In the money” ~ can profitably exercise option – CALL in the money when currency appreciates; hedge accounts payable in foreign currencies – PUT in the money when currency depreciates; hedge accounts receivable in foreign currencies – STRADDLE: CALL and PUT ~ in the money for any large swing in exchange rates ~ useful for highly volatile currencies Hedging and Speculation • Distinction can be fuzzy, but – hedge = reduced risk; speculation = increased risk – Speculation • long position ~ buy FX (any contract) to sell at higher-than-expected future spot XR (future spot higher than expected by market) • short position ~ sell FX you don’t have for future delivery at what you think is higher than expected future spot price; buy spot in future, close your position at a profit (future spot less than expected) • Example – C$5m account payable due 90d. E (spot) = .69$/CAD, F = .67$/CAD. Call option strike = .68$/CAD. Expect $ depreciation. – Future spot = .72 exercise option, save .03/CAD or $150,000 over previous spot, though F @ .67 was better. – Future spot = .65 just buy spot; save .02/CAD over fwd 1. Apa yang mendasari terjadinya pasar mata uang asing (valuta asing)? 2. Sebutkan sistem nilai tukar mata uang 3.Bagaimana proses terjadinya transaksi luar negeri (boleh dijelaskan dengan bagan/gambar)?