Laporan Publikasi Tahunan 2015

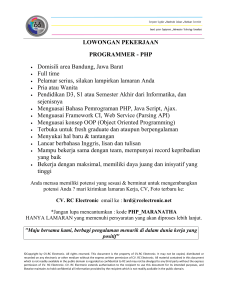

advertisement