annual report - Saratoga Investama Sedaya

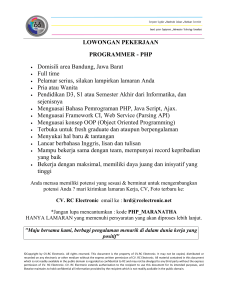

advertisement