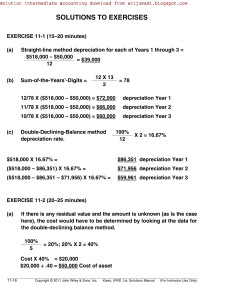

Solution to Continuing Case Problem: Blades, Inc. 1. What type(s) of exposure (i.e., transaction, economic, or translation exposure) is Blades subject to? Why? ANSWER: Blades is subject to transaction and economic exposure, but is not subject to translation exposure. Transaction exposure is the degree to which the value of future cash transactions can be affected by exchange rate fluctuations. Economic exposure is the degree to which a firm’s present value of future cash flows can be influenced by exchange rate fluctuations. Translation exposure is the exposure of an MNC’s consolidated financial statements to exchange rate fluctuations. 2. Using a spreadsheet, conduct a consolidated net cash flow assessment of Blades, Inc., and estimate the range of net inflows and outflows for Blades for the coming year. Assume that Blades enters into the agreement with Jogs, Ltd. ANSWER: 3. If Blades does not enter into the agreement with the British firm and continues to export to Thailand and import from Thailand and Japan, do you think the increased correlations between the Japanese yen and the Thai baht will increase or decrease Blades’ transaction exposure? ANSWER: If Blades does not enter into the agreement with the British firm but continues its current importing and exporting practices in Asia, the increased correlations between the Japanese yen and the Thai baht will reduce Blades’ level of transaction exposure. This is because Blades generates net inflows denominated in Thai baht but net outflows denominated in Japanese yen. For example, if the Thai baht depreciates, resulting in reduced dollar revenue, the Japanese yen will also depreciate, resulting in reduced dollar costs. 4. Do you think Blades should import components from Japan to reduce its net transaction exposure in the long run? Why or why not? ANSWER: Importing components from Japan would probably not be a good way to reduce Blades’ transaction exposure in the long run. Although the correlation between the Thai baht and the Japanese yen is currently quite high, it has been low and unstable in the past. Once the current economic problems that caused the currently high correlation subside, the correlation between the two currencies will probably return to its normal level. Since Blades only reduces its net transaction exposure by importing from Japan because of the high correlation between the two currencies, Blades’ net transaction exposure may actually increase once the correlation between the baht and the yen returns to normal levels. 5. Assuming Blades enters into the agreement with Jogs, Ltd., how will its overall transaction exposure be affected? ANSWER: If Blades enters into the agreement with Jogs Ltd., its overall level of transaction exposure would increase because the resulting transactions would increase Blades’ net cash inflows denominated in foreign currencies. However, the increase in transaction exposure is probably not too high, since the correlations between the two Asian currencies and the British pound are relatively low. For example, a depreciation in the British pound would likely be accompanied by an appreciation in the Thai baht and the Japanese yen. The depreciation of the pound would result in reduced dollar revenue from Blades’ British exports. However, this reduction would be offset by increased dollar revenue from Thailand, even though Blades’ dollar costs incurred due to Japanese imports would also increase. 6. Given that Thai roller blade manufacturers located in Thailand have begun targeting the U.S. roller blade market, how do you think Blades’ U.S. sales were affected by the depreciation of the Thai baht? How do you think its exports to Thailand and its imports from Thailand and Japan were affected by the depreciation? ANSWER: Blades’ U.S. sales were likely negatively affected by the depreciation of the baht since several Thai manufacturers located in Thailand have begun targeting the U.S. roller blade market. This is because Blades’ U.S. customers can obtain foreign roller blades more cheaply with a strengthened dollar. Blades’ exports to Thailand were affected negatively by the depreciation, as the baht it received were converted into fewer dollars. Blades’ imports from Thailand were probably affected positively by a depreciation of the baht, as fewer dollars were needed to obtain the baht to pay for the imports. Since the correlation between the baht and the yen has been high, the yen probably also depreciated, leading to reduced dollar costs for Blades to pay for the Japanese imports.