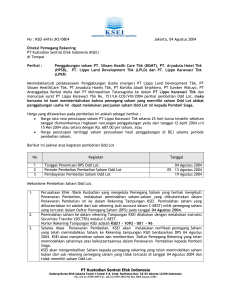

strenGtheninG - Lippo Karawaci

advertisement