Cost System and Cost Accumulation - E

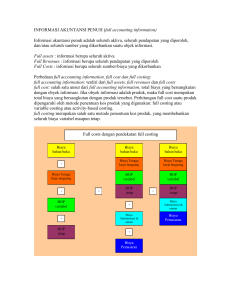

advertisement

CHAPTER 4 COST SYSTEM & COST ACCUMULATION Learning Objectives Present the flow of manufacturing costs using general journal entries and T accounts Prepare financial statements and a statement of COGS for a manufacturer Name different kind of cost systems etc Distinguish between job order and process costing etc FLOW OF COSTS IN MANUFACTURING ENTERPRISE Aliran biaya dalam perusahaan tidak menambah siklus akuntansi dalam akuntansi keuangan. Akuntansi biaya berkaitan dengan pencatatan dan pengukuran elemen pada saat mengalir melalui proses produksi. General ledger untuk proses produksi adalah Materials, Payroll, FOH control, Work in Process, Finished Goods, COGS a) b) c) d) e) f) g) h) i) j) k) l) m) n) o) p) q) r) Payments on account Expenses paid in advance Purchases and improvements of long-lived manufacturing assets Various payments for resources Payments of wages and salaries Purchases of raw materials and factory supplies on credit Recording payroll Issuing factory supplies (indirect materials) to production Incurring various indirect manufacturing costs on credit Manufacturing portion of any prepayments that have expired Manufacturing portion of depreciation Manufacturing portion of various other resources used Charging all types of indirect labor cost to production Issuing direct materials to production Charging manufacturing overhead costs to production Charging direct labor cost to production Charging cost of completed units to the finished goods account Charging cost of sold units to the cost of goods sold account Source Documents Involving Manufacturing Costs Cost Examples of Source Documents Materials Purchase invoices, materials requisitions Labor Time tickets or time sheets, clock cards Factory Overhead Vendors’ invoices, utility bills, depreciation shedules REPORTING THE RESULTS OF OPERATIONS Sebagaimana laporan keuangan konvensional maka laporan keuangan perusahaan manufaktur adalah: 1. Income Statement 2. Cost of Goods Sold Statement, schedule 1 3. Balance Sheet 4. Cash flow Statement See : Exhibit 4-2, 4-3, 4-4 page 4-8, 4-9, 4-10 COGS STATEMENT Manufactured cost = Direct Materials consumed + Direct Labor + FOH FOH merupakan akun untuk menampung semua Indirect Material/supplies Cost + Indirect Labor Cost + Other FOH Cost yang berkaitan dengan factory (pabrik) Manufactured cost akan sama dengan COGM dan COGS, jika tidak ada persediaan awal dan akhir untuk WIP dan Finished Goods COST SYSTEM Macam-macam cost system : 1. Actual cost system atau Historical cost system Cost dikumpulkan pada saat terjadinya, namun pelaporannya ditunda pada akhir periode akuntansi 2. Standard cost system Standard cost digunakan berdasarkan biaya yang ditetapkan terdahulu. Actual cost juga dicatat dan variance dimasukan dalam akun terpisah. COST SYSTEM (continue) 3. Full Absorption Costing. Biaya produksi dikumpulkan baik yang bersifat tetap maupun variabel. 4. Direct Costing/Variable Costing. Biaya yang termasuk biaya produksi hanya yang bersifat variabel saja see : figure 4-3, page 4-12 A Classification of Cost Systems Manufacturing Cost Elements Allocated to Production → Costs Measured at ↓ Historical Amounts Historical Amounts for Direct Material & Direct Labor, Predetermined Amount for Overhead Predetermined Amounts Direct Material, Direct Labor Direct Material, Direct Labor, Variable Overhead Direct Material, Direct Labor, Variable Overhead, Fixed Overhead (1) Actual Prime Costing (4) Actual Direct Costing (7) Actual Absorption Costing (2) Actual Prime Costing (5) A Hybrid Direct Costing (8) A Hybrid Absorption Costing (3) Standard Prime Costing (6) Standard Direct Costing (9) Standard Absorption Costing COST ACCUMULATION • • • • Ke 4 Cost System tersebut dapat digunakan dalam CostAccumulation, yang meliputi : 1. JOB ORDER COSTING Biaya diakumulasikan untuk setiap batch, lot, job order Produk bersifat heterogen Akun WIP dibantu subsidiary ledger Dapat ditentukan profit per job order Cost Accumulation (continue) 2. PROCESS COSTING . Biaya diakumulasi berdasarkan proses produksi atau departemen. . Produk bersifat homogen/uniform . Biaya per unit dihitung dengan cara membagikan antara jumlah biaya dengan jumlah unit ekuivalen. Cost accumulation (continue) 3. Blended Methods Direct material cost diakumulasi berdasarkan job order costing dan convertion cost diakumulasikan berdasarkan process costing. Cost accumulation (continue) 4. Backflush Costing Dalam kasus proses produksi yang sangat cepat, yang mengakibatkan hasil produksi mendahului pencatatan akuntansi maka melakukan backflush dapat dijadikan pilihan yang sangat penting. Backflushing costing dianggap dapat menjawab kekunoan kronologis pencatatan akuntansi COMPARISON OFCOST ACCUMULATION METHODS 1. Berbeda dengan metode Job Order, Blended dan Process Costing, metode Backflush tidak mengenal adanya Work in Process. 2. Masing-masing metode menunjukkan perbedaan objek biaya yang menjadi tujuan penelusuran biaya.